Change Financial, along with Mastercard and Fintech Actuator launched their Australian first Prepaid Incubator Program at Fintech Australia’s Intersekt Festival in Melbourne.

A panel session, Creating Change and Mastering the Art of Issuing with Fintech Actuator was hosted by Simone Thompson from Thoughtworks. The panel saw Ashima Chaudhar, Mastercard VP Head of Development, Vinnie D’Alessandro Change Financial Chief Product Officer and Tim Boucaut from Fintech Actuator explain the value of the program.

You can view the panel session here.

To find out more about or apply to be part of the Incubator Program, head to https://www.fintechactuator.com/

- Change Financial wins new client, HealthNow and together they aim to revolutionise workplace wellness in New Zealand

- HealthNow’s Employer Aid sets a new standard for workplace wellness, empowering employers in supporting employee wellness and health improvement

- Employer Aid aims to provide New Zealanders with a seamless payment experience through a one-card approach

- Employer Aid will integrate with Change Financial’s Vertexon payments platform, leveraging Change’s Mastercard issuing capability in New Zealand, ensuring a robust and reliable payment infrastructure for HealthNow’s clients

Auckland, 24 August 2023: Change Financial Limited (Change), a leading ASX-listed (CCA) Australian payments fintech, is thrilled to announce New Zealand health services pioneer, HealthNow, has chosen Change’s Vertexon platform to power their Employer Aid prepaid card program. Employer Aid is set to revolutionise how New Zealand employers support and promote the health and wellness of their employees.

Employer Aid, powered by Change’s Vertexon platform and leveraging its Mastercard issuing capability in New Zealand, is HealthNow’s solution to the growing need for proactive health solutions in the workplace. 1 According to the 2023 Global Survey by Virgin Pulse and YouGov,

76% of workers believe their company should be doing more to support the mental health of their workforce.

The program works closely with employers to educate staff on how to use their health allowances effectively, ensuring they remain healthy and well. The one-card approach eliminates barriers, offering a smooth payment experience and acting as a constant reminder for employees to prioritise their healthcare.

Tony Sheehan, Change Financial Chief Executive Officer, said, “It’s exciting to have HealthNow as a new client and to enable them to achieve their vision of launching Employer Aid. This collaboration is a testament to our shared commitment to providing innovative financial

solutions tailored to the needs of New Zealanders.”

Steven Zinsli Founder & CEO of HealthNow highlighted the program’s innate ability to adapt to the different needs of each employee.

“Employer Aid allows employers to acknowledge the diverse health needs of their employees, recognising for example that the ideal employee benefit for a 25-year-old differs from that of a 50-year-old. “Our program provides an effective alternative to traditional health insurance, shifting the focus to

preventative healthcare. By allowing employers to select their contribution value, we ensure that Employer Aid fits seamlessly into any budget,” Mr Zinsli commented.

With Employer Aid, HealthNow is offering both a payment solution and championing a shift in how employers view and support employee health. By focusing on preventative rather than reactive healthcare, HealthNow is setting a new standard for workplace wellness in New Zealand.

New Zealanders can anticipate the launch of the Employer Aid prepaid card program towards the end of 2023, marking a significant step forward in health-focused financial solutions.

HealthNow and Change Financial are exploring expanding their partnership into the Australian and US markets in the coming months.

1 2023 Global Survey of workplace wellbeing priorities, by Virgin Pulse and YouGov, May 2023

- Simply Zibra is launching AI-powered virtual cards through Change Financial to empower consumers to spend in a smarter way.

- Simply Zibra seeks to drive better financial outcomes for consumers by using AI to source loyalty program benefits, low fees, cashback incentives and rewards points on everyday payments – automatically.

- Change Financial will provide Mastercard card issuing to provide the payments capability in market

Brisbane, 15 August 2023: Change Financial Limited (Change), a leading ASX-listed (CCA) Australian payments fintech, today announced it will provide Mastercard card issuing to Simply Zibra, an AI-driven digital wallet that helps consumers get the most out of their money. Using AI, the system optimises every payment made via the Change issued Mastercard through analysing the transaction in real time and selecting the card that will provide the most benefits for the consumer. These benefits can include lower foreign exchange fees and interest, frequent flyer miles, cashback opportunities and rewards points, depending on the preferences and goals of the user.

Change Financial Chief Executive Officer, Tony Sheehan, said the partnership aims to offer unprecedented benefits for consumers, by allowing them to automatically receive third party savings that they may not otherwise be aware of. “We are proud to be powering Simply Zibra’s innovative technology with our card issuing capabilities. Their commitment to supporting financial optimisation through AI-driven personalisation is a breakthrough for Australian consumers.” said Mr Sheehan. “Our card issuing capabilities have helped bring this innovation to market and it will facilitate the use of this technology for online and in-person payments, with consumers able to reap the rewards in a matter of seconds.”

The platform links all of a consumer’s accounts including debit cards, credit cards and saving accounts, to ensure that the AI process can work efficiently, by drawing on spending habits and information from a broader range of sources. Simply Zibra upholds data security by partnering with licensed entities to safely store financial data. The company does not hold a customer’s funds and has ‘read-only’ access to information.

Simply Zibra Chief Executive Officer, Trina Ray Choudhury, said by connecting a user’s existing suite of cards and accounts to automate payments, they can deliver greater financial outcomes for consumers through harnessing the benefits of AI. “We are delighted to join forces with Change Financial. Together we’re able to bring a pioneering payments tool to market that redefines how consumers manage and use their finances. This venture brings us one step closer to our goal of enhancing the financial lives of Australians.” Mrs Ray Choudhury said.

“Consumers are often missing hundreds of dollars in potential savings and by using AI, our technology works in the background, automatically applying relevant savings or even earning hidden rewards, without the consumer having to spend hours sorting through information.

This product and service will be available to the market towards the end of 2023.

Fintech Australia – Member Announcement

- Change’s principal issuer capability through Mastercard will allow the company to directly issue cards to clients in Australia

- Ability to tap into direct issuance allows smaller operators to bring their card programs to market faster by removing red tape

- Change also launches their Banking Identification Number (BIN) sponsorship in Australia

Australian-based global fintech and payments as a service (PaaS) provider, Change Financial (Change), today announced the launch of direct issuing services for prepaid and debit card programs in Australia. This offering will enable local bank and fintech clients to offer a card program to consumers through the technology of both Mastercard and Change Financial.

Chief Executive Officer of Change Financial, Tony Sheehan, said card programs with this depth of features have previously only been available to larger banks and fintechs due to the costs, operational processes and scale required.

“We are committed to making this technology accessible to Australia’s growing number of fintechs and smaller banks, and this partnership is levelling the playing field for local companies, by allowing them to access program features previously unattainable,” Mr Sheehan said.

The partnership draws on the respective strengths of both companies, utilising Mastercard’s global payment network and technology, to enable Change’s customers to create and launch prepaid and debit card programs across the nation.

“This is facilitating Change’s ongoing expansion by unlocking new lines of business and allowing the company to create Mastercard programs and offer them to market on behalf of clients.”

“In Australia, we continue to see fintechs, credit unions and mutual banks struggle to provide modern technology solutions such as Apple Pay and Google Pay and this partnership will also help bridge the gap and again level the competitive playing field.”

“By outsourcing issuance, banks and fintechs can focus on their core business and leverage the loyalty they’re known for, generating more customer satisfaction while creating new revenue and data streams.”

Change has also launched its Banking Identification Number (BIN) sponsorship offering in Australia and New Zealand, enabling global companies without local issuing capabilities to access Change’s principal issuing status with Mastercard.

“By launching our BIN sponsorship offering, we are now able to act as an issuer for global companies looking to operate in the region, which is a key advantage for these companies as they can avoid the expense and administrative process of becoming an issuer in every region.”

Change Financial Chief Product Office, Vinnie D’Alessandro wrote an opinion piece for Dynamic Business about how Australian fintechs can lead the way in the US payments space.

The US is a key player in the global financial system. Yet it appears to be lagging behind the global frontier when it comes to adopting modern payment solutions.

Vinnie D’Alessandro

Check out the article here https://dynamicbusiness.com/leadership-2/expert/opinion/do-aussies-have-the-key-to-unlocking-payment-potential-in-the-us.html

When it comes to choosing a new card payment platform, there are certain technical features that are essential for ensuring a smooth, convenient, and secure experience. Here are the five essential technical features to look for in a card payment platform:

Features

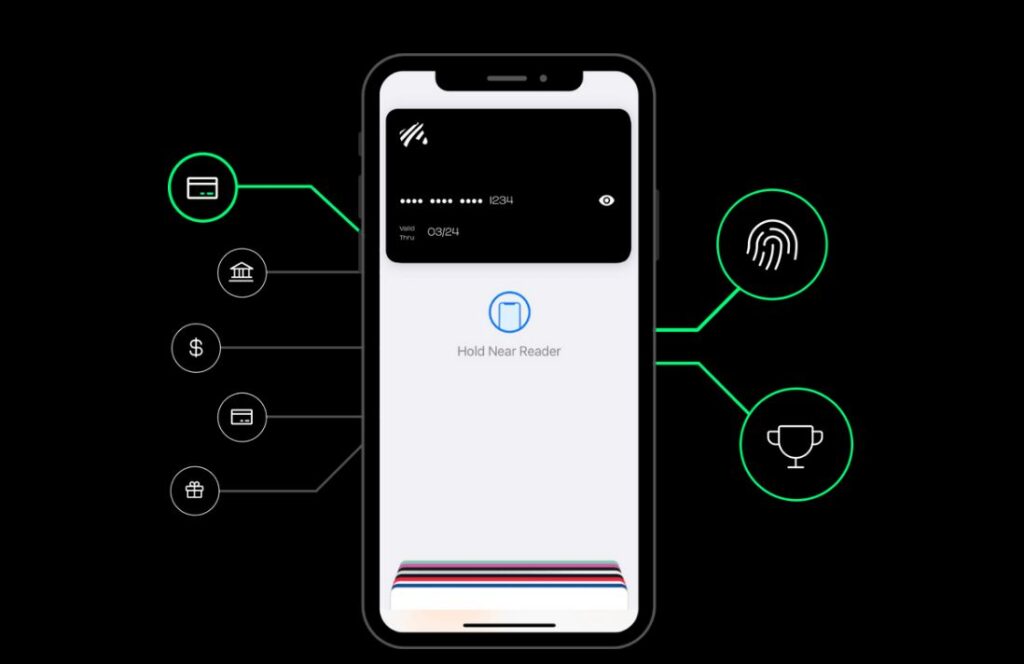

- Integration with digital wallets: Digital wallet platforms like Apple Pay, Google Pay, and Samsung Pay are becoming increasingly popular, and it’s important to choose a card payment platform that can integrate with these systems. This will allow you to make payments using your digital wallet, which can be more convenient and secure than using a physical card.

- APIs for mobile development and integration: If you’re a developer or you plan to integrate the payment platform into your own mobile or web-based application, it’s important to choose a platform that offers APIs (Application Programming Interfaces) for easy integration. This will allow you to customize the payment experience and build a seamless integration into your application.

- Cardholder self-service: To give cardholders more control and convenience, look for a card payment platform that offers self-service features such as the ability to reset a PIN, block a lost or stolen card, or pause a card temporarily. These features can be especially useful in the event of a lost or stolen card, or if you need to take a break from using your card for a while.

- Security and fraud protection: Finally, it’s essential to choose a card payment platform that offers robust security and fraud protection measures. This can include features like 3D Secure (3DS), which is a security protocol that helps to protect online card transactions, as well as encrypted data transmission, secure servers, and regular security updates.

- Virtual cards: Another useful feature to look for is the ability to create virtual cards. Virtual cards are digital versions of physical cards that can be used for online transactions, and they offer a number of benefits. For example, you can create separate virtual cards for different types of purchases or for different family members, which can help to keep your finances organized and separate. Virtual cards also offer an extra layer of security, as they can’t be lost or stolen like physical cards can.

Vertexon: delivering modern card payment solutions

Vertexon is a Payment as a Service (PaaS) platform developed by Change Financial. It is designed to provide modern and digital payment experiences for businesses and consumers.

One of the key features of Vertexon is its integration with digital wallets. This allows users to store and manage their payment information in a digital wallet, such as Apple Pay, Google Pay or Samsung, and make payments online or in-store using their mobile device.

Vertexon also includes APIs (Application Programming Interfaces) that allow businesses to integrate the platform into their own systems and processes. This can enable them to create customised payment experiences for their customers.

Cardholder self-service is another feature of Vertexon. This allows cardholders to manage their own card and PIN, and check their transaction history.

Security and fraud protection are also important considerations for any payment platform. Vertexon includes multiple layers of security to protect against fraud and unauthorized transactions, including encryption, secure authentication, and real-time monitoring.

Finally, Vertexon supports the use of virtual cards. Virtual cards can be especially useful for businesses that need to make frequent online payments, as they can be easily generated and managed through the Vertexon platform.

Are you looking for these essential features to modernise your card platform, reach out to our sales team.

To see all the features of Vertexon, check out our roadmap.

Change Financial CPO, Vinnie D’Alessandro made an appearance on ausbiz with Kyle Rodda to discuss payments in the Australian, New Zealand and US markets.

https://www.ausbiz.com.au/media/the-state-of-payments-in-australia?videoId=25918§ionId=1885

Chris Titley, host of FinTech Australia’s podcast, sat down with Change Financial Chief Product Officer Vinnie D’Alessandro to talk about the changing landscape of payments globally with a particular focus on the Australian market.

You can find the via the link below or search for FinTech Australia Podcast – Remember your pin? in your favourite podcast app.

Having attended my first Customer Owned Banking Association conference (COBA) with Change Financial, I was hoping for a positive experience after such a long break between in person conferences and my expectations were far exceeded.

The Customer Owned Banking Association put on a wonderful event , one of the best I’ve attended in my career. Aside from the professionally executed conference, panels, sessions, food, and entertainment, it was the COBA members that had the greatest impact on me. They were open, positive, engaging, and curious.

The COBA 2022 conference panels, sessions and workshops centred around three key themes; Smart. Strong and Sustainable.

Whilst that is an accurate description of COBA member banks, I took away a different set of themes from the members in attendance: Enhance, Compete and Grow.

Enhance: Not surprisingly, COBA members were focused on their customer experience, it was central to almost every conversation I came across. There was an acceptance from members that their products and services needed to be enhanced. COVID has been a catalyst for greater investment in remote and digital bank services and COBA2022 showcased many of these new capabilities that banks can deliver to their customers.

Compete: COBA members are often competing for the same customers as the big 4 and larger tier 2 banks. Customer owned banks can’t compete with the big guys in terms of budgets, but through partners and SaaS offerings, there is an opportunity to match their services and provide a better customer value proposition. A great comment from one of our customers I spoke to was “I want to own my own destiny for card payments, but I don’t have to do it all on my own”.

Grow: Nearly every bank I spoke to wanted to grow their customer base. In particular, focus on new, younger customers to drive a sustainable future. Whilst murmurs of mergers and acquisitions continue, COBA members are keen to enhance their services, compete with the bigger players and ultimately grow their customer base.

The Change team was both encouraged and inspired by the energy, enthusiasm and positivity from the COBA team and their members. We’re looking forward to supporting the transformation journey for customer owned banks as they continue to enhance, compete, and grow to better rival the major banks in the future.

Change Financial (CCA) has announced it has been granted a Mastercard Principal Issuer licence for Prepaid and Debit cards in New Zealand.

Being a Mastercard Principal Issuer allows Change to deliver card programs to banks, credit unions, fintechs and other businesses, looking to offer digital and physical card payments to their customers.

In March 2022, Change announced an exclusive agreement to partner with Mastercard to issue prepaid and debit card products in Australia and New Zealand.

Change CEO, Alastair Wilkie commented, “We are excited to be a Mastercard Principal Issuer in New Zealand for Prepaid and Debit cards. To be granted our licence less than 6 months after our Mastercard partnership announcement is a wonderful result for both parties.”

Wilkie continued, “Our business has a long New Zealand heritage and it’s a proud moment for our business, especially our Auckland based team members. Our new capability will allow us to lower the barrier of entry for New Zealand banks, credit unions, fintechs and business to deliver innovative card solutions to their customers.”

Change also recently announced they would be issuing Mastercard debit cards for First Credit Union, Nelson Building Society, Police and Families Credit Union and Westforce Credit Union.