Company

Our story

Explore Change Financial’s journey to becoming a leading global fintech, delivering payment solutions around the world

Our mission

Simplifying payment experiences worldwide

Change is a payment’s solution provider, driving innovation in the Payments as a Service ecosystem.

Banks and fintech firms need to facilitate in person and digital payments for their customers. Our innovative products provide that underlying infrastructure that supports modern payment solutions.

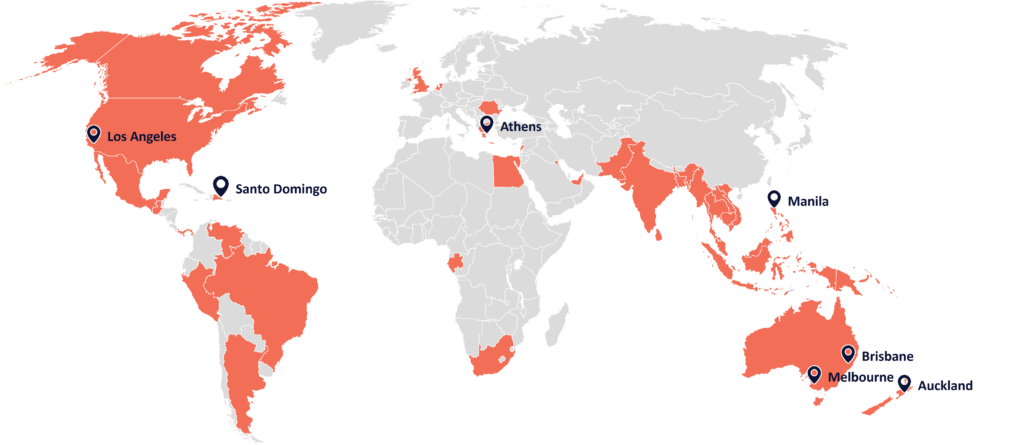

Global Fintech with local expertise

We have over 80 staff across 5 countries including Australia, New Zealand, Philippines, Greece and the Dominican Republic.

Our team supports over 150 clients across 40 countries.

Our Journey

2015

Company founded

2016

Launched on the ASX

2017

Rebrand to Change Financial

Pay Awards

– Start-up of the Year

– Best Mobile App

– Consumer Champion

2019

Mastercard Certified Processor

Partners with US issuing bank

2020

PCI-DSS Certified

Launched US Prepaid Mastercard and mobile app

Acquisition of Wirecard Australia and New Zealand staff and assets

2021

Launched Vertexon brand and roadmap

Launched PaySim brand and roadmap

Launch of Vertexon SaaS in Oceania

Partners with second US issuing Bank

2022

Mastercard Direct Issuing in Australia and New Zealand

Mambu Partnership

Registered as New Zealand Financial Services Provider

PaySim API Launch

2023

Mastercard US Partnership for Debit and Prepaid

Australia Financial Services Licence Granted

Mastercard NZ Issuing Live

Our History

Change Financial (Change) is a global fintech, providing payment solutions to banks and fintechs. Change partners with clients to provide simple, flexible, and fast to market payment solutions and services.

Change began life by providing a retail banking service via a mobile app and prepaid debit cards to the unbanked and under-banked in the U.S.

“The whole purpose was to give these under banked access to cash through ATMs but there was no credit facility. Ultimately, Change had over 300,000 customers who had decided to activate a card, and this gave them access to money through the banks,” Mr Sheehan said.

By broadening the digital channels that customers could use to access its services to include Facebook and Google, Change grew rapidly to the point that by the end of 2019 it had been registered as a Mastercard payments processor. This made it the first card issuing and payment platform to complete this process in the previous five years and only the second fintech to achieve this status in the previous 20 years after Marqeta Inc.

In 2020 Change took another leap forward with the acquisition of the Australia and New Zealand business assets of Wirecard whose clients included the big four Australian banks and major supermarket chains.

Change has now emerged as a critical service provider that connects licensed banks with companies to provide integrated payment processing and card management services. It also offers performance and maintenance services to ensure business clients meet high standards.

Through its customisable payments platform Vertexon, Change helps businesses to issue cards, digital wallets, and BNPL systems; enables access to major card schemes like Mastercard, VISA and AMEX, and offers Apple Pay and Google Pay services.

Vertexon’s Payments as a Service (PaaS) model connects existing licensed banks with modern application programming interface (API) driven businesses. Its payments technology provides the software infrastructure that enables clients to offer a sophisticated, quick to market, payments capability. Vertexon enables banks and fintechs to launch card programs and solutions in a cost-effective manner, reducing operational, compliance and regulatory burdens for our clients.

Change’s PaySim offers a full end-to-end payment testing solution to ensure clients meet the capability and performance expectations of their customers by simulating the full transaction lifecycle. PaySim’s API enables clients to automate their testing functions and integrate it with their testing and quality assurance toolsets.

Along the way to reaching this total product offering, Mr Sheehan said the company faced two key challenges.

“The first was the strategic move to being a processor as well as being a payments platform service provider, effectively moving from prepaid to a debit and credit card processor. This took over two and half years to complete because of all the regulatory requirements,” he said.

“The second major challenge was how to encapsulate all the evolving consumer payment needs like mobile access, virtual and digital cards, and the newly emerging payment options like Apple Pay and Google Pay.

“This was all about creating a wider remit of how you pay which all required a major expansion in technology. This also had to be done without ending up costing clients a lot of money,” Mr Sheehan said.

While Change developed a technology strategy to do this in 2020 which it estimated would take up to three years to implement, fortunately at the same time along came the Wirecard acquisition.

“I estimate that 70 to 80 percent of what we were trying to achieve within three years was available to us by making a strategic acquisition of Wirecard’s assets,” Mr Sheehan said.

“We also got access to a highly trained staff and a large revenue base generated from around the world. In all it brought forward our three-year strategic plan by about 18 months,” Mr Sheehan said.

“We are engaging with those opportunities, like Crypto and BNPL, that really help to improve the consumer interaction with payments,” Mr Sheehan said.

In 2021, Change engaged Deloitte to develop and validate our product roadmaps and go-to-market strategy which is being executed in our key markets.

Change is building momentum in the Australian Payments as a Service (PaaS) space, leveraging its experience in the US market to become a truly global solutions provider.