Change Delivers Cards and Buy Now Pay Later capabilities for Philippine’s largest bank

- BDO is the Philippines largest bank with with total assets of US$70 billion and more than1,400 operating branches and 4,400 ATMs nationwide

- BDO leverages Vertexon for managing its card programs and services including

- Mastercard, Visa, UnionPay, Amex, JCB, Diners card schemes

- BNPL features for its Major Purchase and Installment card products

- Dispute Management System

- Recently upgraded to the latest version of the Vertexon platform

- BDO utilises PaySim, Change’s payment simulation and testing solution,.

A key customer of Change, the Philippines’ largest bank, BDO Unibank, Inc. (“BDO”), have integrated many of Change’s Vertexon payment solutions to issue and maintain their card programs and merchants. BDO also utilises PaySim, Change’s payment simulation and testing solution.

BDO is the Philippines’ largest bank with total assets of US$70 billion and one of the widest distribution networks across the country consisting of more than 1,400 operating branches and over 4,400 ATMs nationwide.

A senior vice president of BDO shared the following testimony:

Senior Vice President of BDO

“We have been using Change’s solutions to operate and expand our credit card products and offerings. Over that time we have grown our credit card portfolio to the largest in the Philippines.

Change’s staff are very knowledgeable, professional and cooperative throughout each project. They have helped us bring many innovative and flexible payments solutions such as Buy Now Pay Later and Major Purchases capabilities to market quickly.”

BDO on the latest version of Vertexon

In October 2021, Change completed BDO’s card platform upgrade to the latest version of Vertexon. This upgrade offers BDO the latest card payment technology, including BNPL features.

BDO’s Credit Card Systems Team commented: “We had a very successful upgrade to the latest Vertexon platform version with the upgrade experience seamless for such a major undertaking. The new version added expanded features and at the same time carried over bespoke business functions that give us market leadership. Change’s technical team has time and again proven their proficiency and allowed for an efficient project

implementation.”

Vertexon powering physical and digital card payments

- Change’s Vertexon power over 450,000 digital and physical card products for ME

- Features include Apple Pay, Google Pay and other contactless payment options

- Virtual cards can be delivered to ME customer wallets within minutes

- Change is working with ME on its technology and solutions roadmaps

- New transaction streaming technology being delivered to support ME’s Open Banking and Consumer Data Right (CDR) initiatives

Partnering for the payment revolution

Leveraging Change’s Vertexon payments technology, ME Bank (“ME”) has rolled out over 450,000 innovative debit and card products to its Australian customers. Using Change’s PaySim payments simulator and testing platform, ME has also ensured its products are stable and scalable before being released to market.

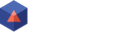

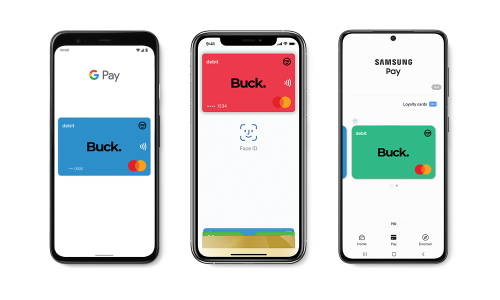

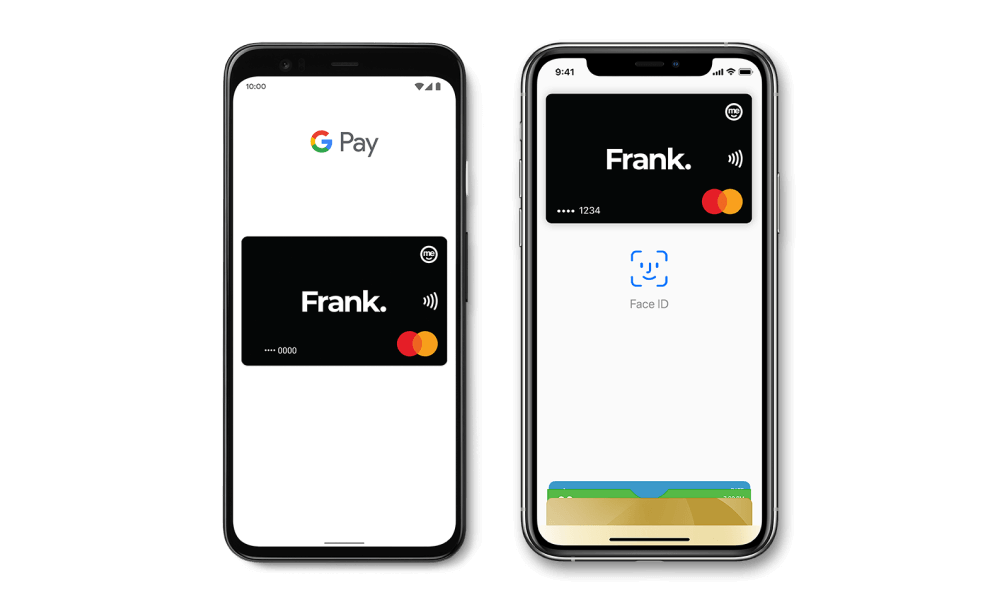

ME’s card products include the Buck card, a digital and physical Mastercard debit card and Frank, a low rate physical and digital Mastercard credit card.

ME and Change work closely together to improve the bank’s card platforms, including transaction streaming, to support Open Banking and Consumer Data Right (CDR) initiatives.

The future is open, digital and now

Sharing his thoughts on the partnership with Change, ME Bank General Manager of Core Banking, Paul Cazaz, said, the bank strives to bring innovative products to customers.

“We are very proud of our Buck and Frank cards. Partnering with Change to deliver the digital wallet capabilities has been rewarding and timely, given the global pandemic is driving cashless payments,” Cazaz said.

“We have a strong partnership with Change and we are excited by their technology and solutions roadmaps.

“Currently we are working with Change on our next range of products in order to better serve our customers in the evolving digital payments landscape,” he said.

ME’s current card features

ME’s Buck card can be delivered to a customer’s digital wallet in five minutes, allowing them to use the EFPTOS and Mastercard payment networks almost instantly, and without waiting for a physical card. As well as automatic refunds for Australian ATM fees, Buck comes in a choice of colours that are inspired by Australian banks notes.

Available in black or white, features of ME’s Frank card include the ability to add additional card holders, a 55-day interest free period as well as access to Mastercard’s Priceless rewards program.

The Buck and Frank cards are connected to Apple Pay and Google Pay, allowing customers to leverage their iPhone, iPads, iWatch, Android phones, tablets and smartwatches to make payments in store or online. Buck and Frank also support digital payments using Fitbit Pay and Garmin Pay, allowing ME cardholders to pay with a tap of their wrist, while on the run.

The digital and security features of the Buck and Frank cards include:

- EMV chip for contactless payments

- Mastercard® Identity Check™

- Apple Pay

- Google Pay

- Fitbit Pay

- Garmin Pay

- Card Lock via Mobile App and Internet Banking