Speed, reliability and innovation are non-negotiables in today’s digital payments environment. Yet for many banks, fintechs, and processors, outdated testing methods are creating a hidden bottleneck – slowing down deployments, increasing operational risk, and making it harder to keep up with regulatory changes.

Manual testing can’t keep pace

Legacy approaches to testing such as manual scripts, single-transaction test tools, and fragmented QA environments, weren’t built for the complexity of today’s payment ecosystems. Whether you’re launching a new card program, integrating with a new scheme, or updating your core systems, relying on limited testing can introduce risk at the worst possible time – just before go-live.

Ask yourself:

- Can your team run thousands of test transactions in minutes?

- Do you have visibility across all payment rails?

- Are you confident your systems will perform under real-world stress?

If the answer is “not really,” it’s time to consider a smarter approach.

What modern payment testing looks like

Modern payment testing solutions, like PaySim, take a simulation-first approach. That means you can emulate real payment traffic, test full transaction flows, and run thousands of automated scenarios, all before you ever go live.

A good testing platform should:

- Simulate multiple schemes (e.g. Mastercard, Visa, domestic networks)

- Support full lifecycle testing – from authorisation to settlement

- Integrate with your DevOps or CI/CD pipeline

- Reduce your reliance on expensive, time-boxed certification tools

Why Now Matters

As payment regulations evolve and consumer expectations rise, QA teams are under pressure to deliver faster – with fewer resources. Investing in robust simulation early in your development process isn’t just about testing. It’s about protecting your brand, reducing time to market, and building better products.

Ready to modernise your payments testing?

If you’re rethinking your testing strategy or simply wondering if there’s a better way – now’s the time to explore simulation-based testing.

At Change Financial, we’ve helped banks, processors, and fintechs streamline their testing and launch new products with confidence using PaySim – our scalable, real-time payment simulation platform.

Curious to learn more?

Contact the PaySim team today to find out more or to request a demo.

PaySim is Change Financial’s powerful payment testing and simulation software, designed to help banks, fintechs and financial institutions streamline and future proof their payment environments. With PaySim, organisations can confidently test end-to-end payment scenarios at scale, ensuring systems function correctly, remain compliant, and respond effectively to real world conditions.

Below we explore why PaySim is an essential tool for optimising your payments testing strategy.

Automation at Scale

Automation is transforming every part of the payments landscape, and testing is no exception. Traditional manual testing approaches can’t keep pace with the demands of agile delivery, frequent system updates, and complex integrations.

PaySim enables automated simulation of thousands of transactions simultaneously, far beyond what compliance-only tools offer, which typically test one transaction at a time. This allows teams to simulate a wide range of payment scenarios, from routine transactions to edge cases and failure conditions, all in a matter of minutes.

By integrating PaySim into your DevOps or QA workflows, you can:

- Run more tests, more frequently, with fewer resources

- Identify and fix issues earlier in the development lifecycle

- Accelerate deployment timelines with greater confidence

Clear Return on Investment (ROI)

Manual testing is time-intensive, error-prone, and expensive, especially for organisations with complex payment infrastructures. With PaySim, you eliminate repetitive manual test cases and reduce the need for large QA teams to run tests manually.

The platform delivers long-term ROI by:

- Supporting continuous testing, not just point-in-time compliance

- Reducing operational costs tied to regression testing and certification

- Enabling faster deployments and shorter release cycles

PaySim becomes a foundational part of your payment architecture, helping reduce overhead while improving product quality and reliability.

Regulatory Compliance

Regulatory and scheme mandates are constantly evolving. Staying compliant requires rigorous, up-to-date testing across all systems and flows.

PaySim helps organisations:

- Validate conformance with PCI-DSS, scheme mandates, and local requirements

- Proactively adapt to rule changes without last-minute disruptions

- Avoid transaction failures, regulatory penalties, and reputational risk

With automated testing for compliance built into your everyday workflows, your teams can focus on innovation, not chasing mandates.

Whether you’re launching a new payments product, upgrading your infrastructure, or preparing for certification, PaySim gives you the tools to test with confidence. By automating complex scenarios, reducing manual overhead, and ensuring regulatory alignment, PaySim helps banks and fintechs improve reliability, accelerate time-to-market, and reduce operational risk.

Ready to optimise your payments testing strategy?

Contact our team to learn more or book a demo today.

PaySim is Change Financial’s payment testing and simulation tool. With PaySim, you can easily and accurately test your payment systems to ensure that they are working properly and compliant with industry regulations.

Here we’ll explore why PaySim is an essential tool for optimising your payment systems and processes.

Automation

Automation has become an increasingly important part of the financial industry, and payment testing tools are a key aspect of this trend. Banks and fintech companies are using these tools to streamline their payment processes, improve efficiency, and reduce the risk of errors and fraud.

Payment testing tools are software programs that automate the testing of payment systems. This includes everything from the initial transaction request to the final confirmation that the payment has been completed successfully. These tools can simulate a wide range of payment scenarios, allowing banks and fintech companies to test their systems thoroughly and ensure that they are working properly.

Compliance and scheme tools generally operate on a single transaction at a time, however using PaySim allows you to automate thousands of transactions.

Automated testing allows organizations to run more tests in less time, giving them a more comprehensive view of their payment systems and allowing them to identify and fix any issues more quickly.

Return on Investment (ROI)

One of the key benefits of using payment testing tools is that they can help banks and fintech companies to save time and money. Traditional payment testing methods are often time-consuming and labour-intensive, requiring teams of testers to manually carry out tests and analyse the results. This can be a costly and inefficient process, especially for large organizations with complex payment systems.

Other alternatives such as reliance on compliance and scheme tools which are designed for one off certification and to test transactions one at a time is also time consuming and costly compared to automating your day to day transactions via payments testing tools.

Fraud Prevention

Another important benefit of payment testing tools is that they can help banks and fintech companies to reduce the risk of errors and fraud. Payment systems are vulnerable to a wide range of potential issues, from technical glitches to malicious attacks. By using payment testing tools to simulate different scenarios, banks and fintech companies can identify potential vulnerabilities and take steps to fix them before they cause any problems.

Regulatory Compliance

In addition to improving efficiency and reducing the risk of errors and fraud, payment testing tools can also help banks and fintech companies to stay compliant with industry regulations as well as up to date with ever changing scheme mandates. Payment systems are subject to a wide range of rules and regulations, and it is important for organizations to ensure that their systems are compliant with these rules.

On top of the regulations are the various mandated specifications required by banks and fintechs to adhere to. By using PaySim, banks and fintech companies can test their systems to ensure that they are compliant with the latest regulations and using the latest scheme mandates, helping them to avoid transaction failures, costly fines and other penalties.

Summary

Overall, PaySim is essential for banks and fintech companies looking to improve their payment processes and reduce the risk of errors and fraud. By automating the testing process, PaySim can help organizations to save time and money, improve their efficiency, and stay compliant with industry regulations.

For more information on PaySim or to arrange a demo, reach out to our sales team.

To see all the features of PaySim, check out our roadmap.

Change Financial CPO, Vinnie D’Alessandro made an appearance on ausbiz with Kyle Rodda to discuss payments in the Australian, New Zealand and US markets.

https://www.ausbiz.com.au/media/the-state-of-payments-in-australia?videoId=25918§ionId=1885

Change was selected in a cohort of 9 Australian fintechs to participate in the Fintech Australian and Austrade program to help financial services and technology providers scale in the US market.

Across May and June, the cohort will attend the in-person program in New York where they will promote their offering, meet partners, clients, investors and mentors to build their US market presence. The cohort will also attend the Lendit Fintech 2022 Conference at the end of May, which includes the Demo Day hosted by WEVE Acceleration and Austrade.

Austrade’s Steve Rank, Trade and Investment Commissioner New York, explained “Australia’s fintech sector will be showcased in New York when 9 of the best and brightest Australian Fintech startups visit in May.”

Change will be presented by Clayton Fossett (COO) and Brian Hodgdon (VP – Business Development and Customer Relations) and promote our Vertexon Payments as a Service and PaySim payments simulation and testing products.

Change will be joined by

Change is honored to have been selected along with such esteemed fintechs and looks forward to building our presence in the US.

Change Financial was features in Fintech Australia’s Five Fintech on Friday along with Kanopi, FirstAML, MyLenda, and Radium Capital

Change Financial (ASX:CCA) partners with fintechs and banks, to provide tailored payment, card issuing, and testing solutions. The global fintech has over 146 clients across 41 countries, managing and processing over 16 million credit, debit, and prepaid cards, delivering flexible and fast-to-market payment solutions. Change’s Vertexon provides leading digital and physical card solutions for banks and fintechs. Vertexon makes it simple for clients to launch full featured digital payment experiences to their end consumers fast.

Five of the top ten global payment companies trust Change’s PaySim for payment simulation and testing solution, helping them meet the reliability and performance expectations.

https://www.fintechaustralia.org.au/five-fintechs-on-friday-february-4-2022/

After onboarding multiple new clients to its global platform, Change Financial (ASX: CCA) is set to convert its recent product launches into new sales opportunities via Stockhead

Fintech payments leader Change Financial confirmed achievement of key platform milestones and new sales in an exciting quarter update this morning.

Among a number of operational highlights, CEO Alastair Wilkie flagged the successful launch of the company’s Vertexon platform, with additional products under development and a strong pipeline of new work opportunities – both in Australia and globally heading into 2022.

“We continued to grow our sales pipeline and see these opportunities progress through the sales funnel. During the quarter, we converted a significant number of opportunities into contracted revenue which will be realised in future quarters,” Wilkie said.

Importantly, Change commenced onboarding its first payments-as-a-service (PaaS) client in the lucrative US market during the quarter and is now pursuing multiple new clients leads across the US, Australasia and Latin America.

Accompanying that strong momentum, Wilkie and the CCA executive team have a clear strategic vision and key performance metrics to drive further growth in the year ahead.

Business highlights

Across the company’s operational objectives, CCA achieved a priority target in Q4 with the successful launch of Vertexon – a modern digital solution for banking clients to unify back-end process for prepaid, debit and credit cards.

During the December quarter, Change launched the Vertexon SaaS platform on Amazon Web Services (AWS) in Sydney, to service banks and fintechs in the Oceania region.

Delivered on schedule and on budget, the platform is highly scalable with the functionality for rapid global rollouts in response to client demand.

Along with that in-market launch, CCA also completed the beta phase of testing on the new Application Programming Interface (API) for PaySim – its SaaS-based automated payment testing solution that allows banks and fintechs to accelerate their development and product release cycles, the company said.

“The API enables clients to automate load, stress and regression testing to produce comprehensive results reporting and is the foundational component of PaySim’s software as a service offering,” CCA said.

As a measure of its product market-fit, PaySim is already in use by five of the top 10 digital payments companies globally, and marks a particularly exciting growth channel for Change.

Client momentum

In line with those key successes in product development, CCA was also able to convert its momentum into a number of new client wins.

Among them was the addition of a new fintech Mastercard prepaid card program in the US, which will deliver a minimum contract value of US$700,000 (~$1.0m) over an initial three-year term.

Client on-boarding is “well-progressed” and is expected to go live in the March quarter 2022, CCA said.

In addition, the company has secured US$1.3m (~$1.8m) of sales across its new product platform, with “US$1.1 million of Vertexon projects and US$200,000 of PaySim projects for existing clients”.

“Change expects further significant client wins to close in the third and fourth quarters of FY22 as opportunities progress through the sales funnel,” the company said.

The net outcome is that investors can look forward to a steady pipeline of growth for new revenue and cash-flow channels, as CCA continues to build its client base.

Importantly, around 55% of CCA’s revenue has been generated from recurring revenue streams.

Contracted ARR increased to US$4.7m, led by the successful onboarding of Change’s new PaaS client in the US market.

And as evidence of its strong momentum, Change highlighted that its sales pipeline grew by a net-24 opportunities in the December quarter to 158, while 23 new client opportunities were won and closed out.

“There was a significant increase in customer invoicing in Q2, particularly in December, which is expected to drive cash collections in Q3,” Change said.

With a scalable platform that services more than 16 million payment cards and 147 clients in 41 countries, CCA continues to carve out a profitable niche in the multi-billion dollar global payments market.

And following a transformative period in the second half of 2021, the company is set for a big year of growth in 2022.

https://stockhead.com.au/tech/change-financial-continues-to-drive-growth/

Mastercard and Visa are moving from 6-digit BINs to 8-digit BINs for prepaid, debit and credit cards in the coming months. Both Visa and Mastercard have confirmed that from April 2022, they will no longer be issuing 6-digit BINs.

With the timing running out, have you tested your cards and payments system are compatible?

What happens if it goes wrong?

- Incorrect routing and authorisation failures

- Unexpected BIN fees / monthly management fees

- Settlement and clearing failures

- Host card management system, affiliate bank processing, reporting failures

- Incorrectly split portfolios across consumer and commercial

The impact of 8-digit BINs

The change to BIN will impact acquirers, issuers and processors. Affected systems may include

- ATMs

- POS devices and terminal

- Switches

- Authorisation and settlement systems

- Data analytics and reporting systems

Payment companies and services providers should be testing their systems to ensure they can acquire, issue and process transactions from cards with 8-digit BINs.

PaySim make testing your payment systems simple

Our payment testing and simulation solution, PaySim helps banks and fintechs ensure their systems are compliant and robust. We have a long history helping companies get ready for changes like the transition to 8-digit BINs.

For our own payments platform, Vertexon, we leverage PaySim internally to ensure we can support any mandated changes from the schemes.

Using PaySim to test 8 digit BINs and more

Payment testing is usually a time consuming and manual process. PaySim makes it simple for you to simulate the full transaction lifecycle and automate your testing processes.

PaySim product is easy to install and a cost-effective tool for accelerating your testing regime.

8 Digit BIN support could be a major internal change for any institution.

PaySim allows you to:

- generate transactions from different sources with different card prefixes.

- Transaction generation

- Transactions with different card prefixes from ATM, POS or Interchange

- Route Testing

- Any updated routing rules are correctly followed

- End to End verification of card prefixes.

- Messages for different card prefixes get processed by the correct processes.

Use PaySim to generate the transactions and authorise replies if required. Then do internal checks that all transactions have been processed as expected with the new 8 Digit BIN rules

If you want to find out more about PaySim or if you’re an existing customer looking for more information about 8-digit BINs, contact us we’re here to help.

Change Financial (ASX:CCA) CEO Alastair Wilkie joined as host of ASX company leaders to share their highlights for 2021 via Stockhead.

It’s been another year of lockdown and supply challenges for all companies dealing with the COVID-19 variants as they pop up. But with challenges, comes opportunities to learn and grow. So as the end of the year approaches, we took the chance to tap our client list and ask CEOs of ASX-listed small caps – from sand miners to cannabis growers to fintechs – what they learnt in 2021, their highlights, and what they hope for in 2022.

Today, we ask: What was your company highlight for 2021?

Alastair explained “We had three really important events”

- Completing our core card management and processing platform in the US and launching it that into market;

- Following that, we made a strategic and transformative acquisition that expanded our US operations into a global payments solutions business. This, in turn, sped up our three-year strategic roadmap by 18 months; and

- We launched our customer ready integrated payments as a service solution “Vertexon.” This was an exceptional performance by the team to achieve that within a year

To hear the experiences from Alastair and the rest of the leader, check out the full article https://stockhead.com.au/news/ceos-look-back-and-share-their-company-highlights-from-2021-2/

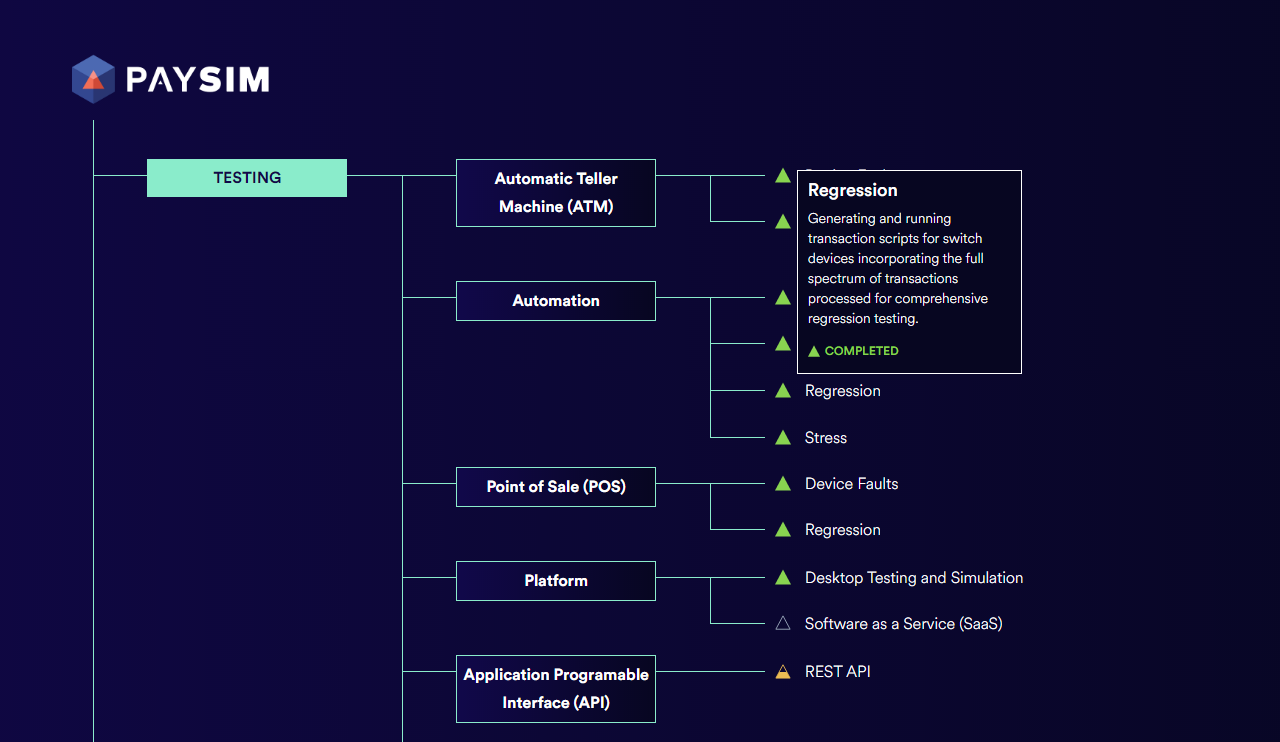

Showcasing the features and future development of our payment testing and simulation solution, Change is proud to launch the PaySim Roadmap.

Our Senior Vice President of Testing Solutions, Ewan Wilson, celebrated the release of the roadmap to Change’s new website. “I’m proud to be able to publish our roadmap for PaySim to our clients and payments industry. Our Product and Technology teams have been focused on delivering new capabilities for our testing solution and it is exciting for us to share our journey with the world.”

Chief Product Office, Vinnie D’Alessandro, explains the importance of Change publishing its product roadmaps. “At Change, we believe in having open and transparent communications. We engage with our clients and partners to help plan and prioritise our new feature development. Sharing our progress and achievements plays a significant driver to deliver transparency to the market.

“Shortly we will be releasing our Vertexon Roadmap to share our Payments as a Service development activities.”

The roadmaps will be regularly updated as features are released and new items are added to the development pipeline.

The PaySim Roadmap is available on the Change website.