Brisbane’s global fintech, Change Financial, unveiled Doing Good Rewards as the debut participant in their ambitious Prepaid Incubator program.

Doing Good Rewards is the world’s first loyalty program to automatically combine shopping discounts and charity giving in the same transaction. Their fresh approach has drawn attention for its powerful social impact and novel application of Mastercard prepaid cards, contributing to merchant onboarding and enhancing business visibility in the Australian market.

“Being chosen as the first participant in this remarkable program marks a pivotal moment for Doing Good Rewards. It validates our innovative approach in blending commerce with charity, and we are thrilled to work alongside esteemed partners like Change Financial, Fintech Actuator, and Mastercard,” said Brad Langdon, Chief Executive Officer of Doing Good Rewards.

“Brad and the team put forward a compelling value proposition and we’re excited that our first incubator participant has such positive social impact goals,” added Tim Boucaut, Managing Director, Fintech Actuator.

In this alliance, Change Financial will issue Mastercard prepaid cards, with Fintech Actuator managing the program, aiding fintechs with comprehensive guidance from onboarding to design and execution.

Mastercard will support the participants with access to industry experience, technology, and connections to help validate their program. Change Financial and Mastercard aim to create an environment that allows emerging fintechs to experiment, innovate, and prosper by offering them a platform to test their prepaid card solutions in the real world.

“This collaboration helps remove many of the barriers for local fintechs to enable card issuing programs, it’s designed to be accessible whilst allowing partners to test, learn and scale,” said Dan Martin, Vice President and Head of Digital Partnerships, Australia at Mastercard.

Each program will run for a period of six to nine months, providing continuous support and guidance to the participating fintechs.

“This innovative incubator program has been crafted with a vision to accelerate the growth and innovation of Australian fintechs, ensuring they have the necessary tools and support to navigate through the initial stages of development and market testing,” said Tony Sheehan, Chief Executive Officer of Change Financial.

To find out more about or apply to be part of the Incubator Program, head to https://www.fintechactuator.com/

Our Chief Product Officer, Vinnie D’Alessandro, recently shared his thoughts on how the RBA is helping Australia lead in the payments space. The article was shared by Dynamic Business.

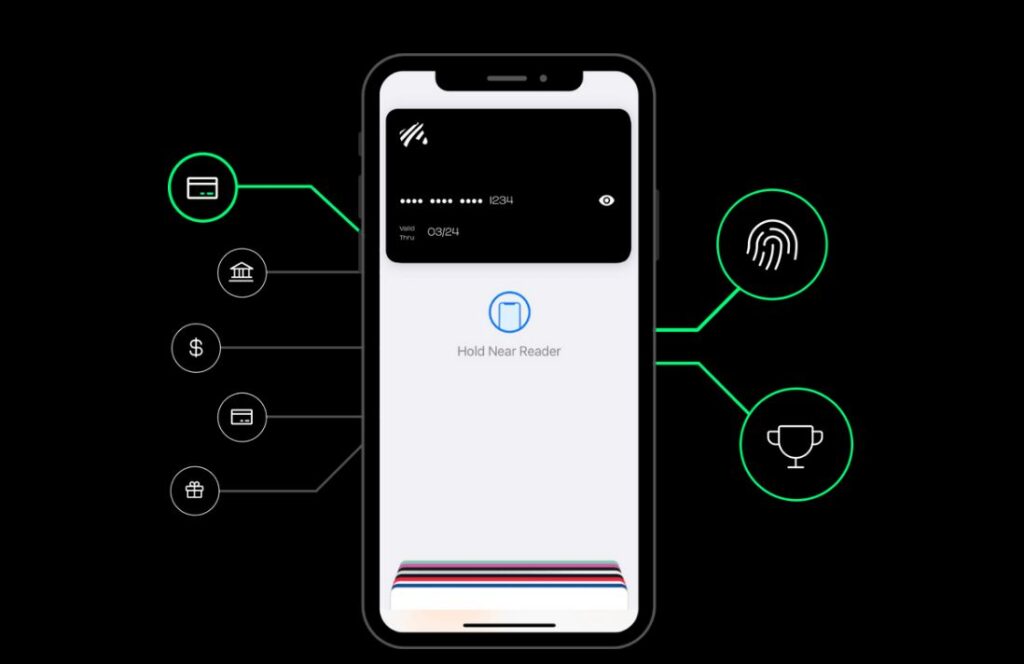

Over the past decade, the global payments landscape has been through a complete digital transformation, from the emergence of digital wallets to functions like Apple and Google Pay becoming consumer standards for everyday payments.

But as consumers become to expect the latest and greatest technology at their fingertips, it is the next decade that we must look to as we prepare ourselves for new technologies, many of which may not even exist yet.

As we look to the future, the Reserve Bank of Australia (RBA) will continue to play a crucial role in ensuring that we are ready and able to grab hold of these innovations, as they are responsible for ensuring the stability, efficiency and competitiveness of the payments system overall.

The RBA, alongside a range of government bodies, successfully enabled modern payments solutions to flourish, supported by the work of the financial services industry in bringing products to market that accelerate this transition.

A key example of this is card payments, which continue to increase according to the 2023 Australian Payments Network’s annual review, which noted card payments were up 14 per cent from 2022, nationwide. Australians have come to expect both a physical and digital card that is linked to their accounts, whether that be a traditional credit or debit card, or modern applications like an employee card that is used for work expenses. This has led to a large number of product providers across the industry, from the big banks to fintechs, creating new ways to pay using cards, whether physically or digitally.

The RBA and the Federal Government more broadly have created policy settings that have allowed this natural transition to take place, whilst balancing the needs of protecting consumers. We look forward to the RBA’s focus on payments continuing as the industry progresses rapidly and demand for clever payments options continue to grow.

In the 2023 McKinsey Global Payments, the company has expressed their view that future revenue growth in the payments space will be stimulated most notably by instant-payments and the rise of digital wallets. The RBA has already provided strong policy frameworks, but product providers are playing catch-up. This is particularly evident in areas such as the use of digital wallets for transport payments and the gap in product offerings amongst smaller banks and fintechs. For digital wallet adoption to grow in Australia, product providers need to provide access to a broader range of people, including those who bank with smaller banks and use fintech services.,.

The New Zealand market is a strong example of where this gap in payments capabilities between larger financial institutions and smaller banks and fintechs is quite prominent. Until recently, it was near impossible for those using smaller providers to access card programs alongside their accounts. This was a gap in the market that companies like Change Financial identified over the last 18 months and by using their technology, they are able to help meet this demand and enable the smaller providers to offer card programs by outsourcing the back end capability. According to 2022 Payments NZ Consumer Research in New Zealand a staggering 84 percent of large purchases are paid using cards and 77 per cent of everyday purchases.

Future areas of expected growth

At Change Financial, we are seeing high demand from clients looking to offer contactless payments and mobile wallets for debit and prepaid cards. While the major banks and financial institutions have longstanding product offerings in these areas, smaller banks and fintechs are continuing to play catch-up, with many still unable to offer digital solutions to customers due to the prohibitive costs associated with the offering. But, with the help of providers like us, these businesses can now outsource that capability. As these features continue to rollout across the industry over time, card programs will continue to cement their place as the dominant means of payment for Australians, a trend we expect to continue in years to come.

The pandemic also accelerated the growth of online payments, with RBA data showing that in 2022, 18 per cent of payments were made online, up from 12 per cent in 2019. While increasing, this proportion is still relatively small when compared to card and other in-person payments and we expect this figure to continue increasing substantially over the coming years. This seamless transition to online payments during the pandemic also showcases the ability of Australia’s policy and regulatory settings to broadly cater for future opportunities and threats as they arise.

Another projected area of growth is the use of cryptocurrency (crypto) for everyday payments. While it is a nascent industry, adoption is increasing as further use cases are developed including crypto payment gateways and crypto-backed cards.

The RBA has undertaken preliminary research and discussions around creating a central bank digital currency (CBDC) and these should continue, as key global economies like the US seek to do the same. This will not only set our nation up for future opportunities, but ensure we are creating a payments ecosystem that encourages healthy competition.

Overall, the RBA must continue to be future focused to prepare for these advances and product providers of all sizes must do the same, to enable a national payments network that accommodates everyone. For this to occur, we must continue to be preparing for these advancements from a product and policy perspective, so that Australia can remain a global leader in the payments space.

Change Financial, along with Mastercard and Fintech Actuator launched their Australian first Prepaid Incubator Program at Fintech Australia’s Intersekt Festival in Melbourne.

A panel session, Creating Change and Mastering the Art of Issuing with Fintech Actuator was hosted by Simone Thompson from Thoughtworks. The panel saw Ashima Chaudhar, Mastercard VP Head of Development, Vinnie D’Alessandro Change Financial Chief Product Officer and Tim Boucaut from Fintech Actuator explain the value of the program.

You can view the panel session here.

To find out more about or apply to be part of the Incubator Program, head to https://www.fintechactuator.com/

- Change Financial wins new client, HealthNow and together they aim to revolutionise workplace wellness in New Zealand

- HealthNow’s Employer Aid sets a new standard for workplace wellness, empowering employers in supporting employee wellness and health improvement

- Employer Aid aims to provide New Zealanders with a seamless payment experience through a one-card approach

- Employer Aid will integrate with Change Financial’s Vertexon payments platform, leveraging Change’s Mastercard issuing capability in New Zealand, ensuring a robust and reliable payment infrastructure for HealthNow’s clients

Auckland, 24 August 2023: Change Financial Limited (Change), a leading ASX-listed (CCA) Australian payments fintech, is thrilled to announce New Zealand health services pioneer, HealthNow, has chosen Change’s Vertexon platform to power their Employer Aid prepaid card program. Employer Aid is set to revolutionise how New Zealand employers support and promote the health and wellness of their employees.

Employer Aid, powered by Change’s Vertexon platform and leveraging its Mastercard issuing capability in New Zealand, is HealthNow’s solution to the growing need for proactive health solutions in the workplace. 1 According to the 2023 Global Survey by Virgin Pulse and YouGov,

76% of workers believe their company should be doing more to support the mental health of their workforce.

The program works closely with employers to educate staff on how to use their health allowances effectively, ensuring they remain healthy and well. The one-card approach eliminates barriers, offering a smooth payment experience and acting as a constant reminder for employees to prioritise their healthcare.

Tony Sheehan, Change Financial Chief Executive Officer, said, “It’s exciting to have HealthNow as a new client and to enable them to achieve their vision of launching Employer Aid. This collaboration is a testament to our shared commitment to providing innovative financial

solutions tailored to the needs of New Zealanders.”

Steven Zinsli Founder & CEO of HealthNow highlighted the program’s innate ability to adapt to the different needs of each employee.

“Employer Aid allows employers to acknowledge the diverse health needs of their employees, recognising for example that the ideal employee benefit for a 25-year-old differs from that of a 50-year-old. “Our program provides an effective alternative to traditional health insurance, shifting the focus to

preventative healthcare. By allowing employers to select their contribution value, we ensure that Employer Aid fits seamlessly into any budget,” Mr Zinsli commented.

With Employer Aid, HealthNow is offering both a payment solution and championing a shift in how employers view and support employee health. By focusing on preventative rather than reactive healthcare, HealthNow is setting a new standard for workplace wellness in New Zealand.

New Zealanders can anticipate the launch of the Employer Aid prepaid card program towards the end of 2023, marking a significant step forward in health-focused financial solutions.

HealthNow and Change Financial are exploring expanding their partnership into the Australian and US markets in the coming months.

1 2023 Global Survey of workplace wellbeing priorities, by Virgin Pulse and YouGov, May 2023

- Simply Zibra is launching AI-powered virtual cards through Change Financial to empower consumers to spend in a smarter way.

- Simply Zibra seeks to drive better financial outcomes for consumers by using AI to source loyalty program benefits, low fees, cashback incentives and rewards points on everyday payments – automatically.

- Change Financial will provide Mastercard card issuing to provide the payments capability in market

Brisbane, 15 August 2023: Change Financial Limited (Change), a leading ASX-listed (CCA) Australian payments fintech, today announced it will provide Mastercard card issuing to Simply Zibra, an AI-driven digital wallet that helps consumers get the most out of their money. Using AI, the system optimises every payment made via the Change issued Mastercard through analysing the transaction in real time and selecting the card that will provide the most benefits for the consumer. These benefits can include lower foreign exchange fees and interest, frequent flyer miles, cashback opportunities and rewards points, depending on the preferences and goals of the user.

Change Financial Chief Executive Officer, Tony Sheehan, said the partnership aims to offer unprecedented benefits for consumers, by allowing them to automatically receive third party savings that they may not otherwise be aware of. “We are proud to be powering Simply Zibra’s innovative technology with our card issuing capabilities. Their commitment to supporting financial optimisation through AI-driven personalisation is a breakthrough for Australian consumers.” said Mr Sheehan. “Our card issuing capabilities have helped bring this innovation to market and it will facilitate the use of this technology for online and in-person payments, with consumers able to reap the rewards in a matter of seconds.”

The platform links all of a consumer’s accounts including debit cards, credit cards and saving accounts, to ensure that the AI process can work efficiently, by drawing on spending habits and information from a broader range of sources. Simply Zibra upholds data security by partnering with licensed entities to safely store financial data. The company does not hold a customer’s funds and has ‘read-only’ access to information.

Simply Zibra Chief Executive Officer, Trina Ray Choudhury, said by connecting a user’s existing suite of cards and accounts to automate payments, they can deliver greater financial outcomes for consumers through harnessing the benefits of AI. “We are delighted to join forces with Change Financial. Together we’re able to bring a pioneering payments tool to market that redefines how consumers manage and use their finances. This venture brings us one step closer to our goal of enhancing the financial lives of Australians.” Mrs Ray Choudhury said.

“Consumers are often missing hundreds of dollars in potential savings and by using AI, our technology works in the background, automatically applying relevant savings or even earning hidden rewards, without the consumer having to spend hours sorting through information.

This product and service will be available to the market towards the end of 2023.

Fintech Australia – Member Announcement

- Change’s principal issuer capability through Mastercard will allow the company to directly issue cards to clients in Australia

- Ability to tap into direct issuance allows smaller operators to bring their card programs to market faster by removing red tape

- Change also launches their Banking Identification Number (BIN) sponsorship in Australia

Australian-based global fintech and payments as a service (PaaS) provider, Change Financial (Change), today announced the launch of direct issuing services for prepaid and debit card programs in Australia. This offering will enable local bank and fintech clients to offer a card program to consumers through the technology of both Mastercard and Change Financial.

Chief Executive Officer of Change Financial, Tony Sheehan, said card programs with this depth of features have previously only been available to larger banks and fintechs due to the costs, operational processes and scale required.

“We are committed to making this technology accessible to Australia’s growing number of fintechs and smaller banks, and this partnership is levelling the playing field for local companies, by allowing them to access program features previously unattainable,” Mr Sheehan said.

The partnership draws on the respective strengths of both companies, utilising Mastercard’s global payment network and technology, to enable Change’s customers to create and launch prepaid and debit card programs across the nation.

“This is facilitating Change’s ongoing expansion by unlocking new lines of business and allowing the company to create Mastercard programs and offer them to market on behalf of clients.”

“In Australia, we continue to see fintechs, credit unions and mutual banks struggle to provide modern technology solutions such as Apple Pay and Google Pay and this partnership will also help bridge the gap and again level the competitive playing field.”

“By outsourcing issuance, banks and fintechs can focus on their core business and leverage the loyalty they’re known for, generating more customer satisfaction while creating new revenue and data streams.”

Change has also launched its Banking Identification Number (BIN) sponsorship offering in Australia and New Zealand, enabling global companies without local issuing capabilities to access Change’s principal issuing status with Mastercard.

“By launching our BIN sponsorship offering, we are now able to act as an issuer for global companies looking to operate in the region, which is a key advantage for these companies as they can avoid the expense and administrative process of becoming an issuer in every region.”