Change Financial has been announced as a finalist for the sixth Annual Edition of FinTech Australia’s most prestigious fintech business awards, the Finnies.

FinTech Australia hosts the annual Finnies Awards which recognises excellence in financial services and technology in Australia. Change has been selected as a finalist for the Excellent in Payments category for 2022.

This is the second year in a row that Change being selected as a finalist, having made the finals for Deal of the Year award in 2021.

Change’s Chief Product Officer, Vinnie D’Alessandro, celebrated the announcement. “We are thrilled that Change has been recognised by FinTech Australia and the Finnies judges for the Excellence in Payments award. It’s recognition for the effort and investment our team has put into our Vertexon and PaySim products.”

The full list of finalists are available here. The Finnies Awards ceremony June 23rd at a gala event at the Forum Theater in Melbourne. Tickets will be available from the Finnies website https://www.thefinnies.org.au/

- Exclusive six-year direct issuing partnership with Mastercard for prepaid and debit cards in Australia and New Zealand.

- New agreement strengthens Change Financial and Mastercard’s long-standing relationship in the US market.

- Change Financial provides mid-sized banks and fintechs with a faster path to market for prepaid and debit card products.

Australian based global fintech and payments as a service (PaaS) provider, Change Financial (Change), today announced an exclusive six-year direct issuing partnership agreement with Mastercard in Australia and New Zealand. Under the agreement Change will begin issuing prepaid and debit cards in both countries from Q4 FY22.

Change CEO Alastair Wilkie said, “This agreement strengthens our long-standing relationship with Mastercard in the US, and transaction processing for existing clients.

“Our partnership with Mastercard will deliver direct issuing capabilities for our Australian and New Zealand clients, giving them a faster path to market for innovative prepaid and debit card products.”

Change uses innovative and scalable technology solutions to provide tailored payment solutions, card issuing and testing to banks and fintechs. The company manages and processes more than 16 million virtual, credit, debit and prepaid cards worldwide. Change’s payments technology and management services are used by over 147 clients in 41 countries. Clients include BDO Unibank, ME Bank and eftpos Australia.

Dan Martin, Vice President, Digital Partnerships, Australasia, Mastercard said, “There’s a significant opportunity to provide Australian and New Zealand’s mid-sized banks and fintechs with the tools and services to best meet the changing expectations of a more digital world. This partnership brings the best of our respective strengths, including Mastercard’s global payment network and technology, to enable Change’s customers to create and launch prepaid and debit card programs seamlessly, safely and securely.”

This agreement follows Change’s recent launch of Vertexon, a payments platform with host multitenancy and dedicated PaaS platform for Australian and New Zealand clients. Vertexon seamlessly integrates with a businesses’ core systems enabling them to easily deliver physical and digital card solutions to their customers as well as offering other features such as Buy Now Pay Later (BNPL), transaction processing and integrated loyalty programmes.

Change is currently being onboarded on to the Mastercard Network to complete testing to onboard customers onto their PaaS platform from Q4 2022.

“Our partnership with Mastercard will deliver direct issuing capabilities for our Australian and New Zealand clients, giving them a faster path to market for innovative prepaid and debit card products.”

- Change’s direct issuing capability follows partnership with Mastercard in Australia and New Zealand.

- New capability allows clients to reduce operational burden and create new lines of revenue.

- Ability to tap into direct issuance is a key strategy for smaller operators as they go on the offensive with digital payments.

SYDNEY, 15 March 2022: Australian based global fintech and payments as a service (PaaS) provider, Change Financial (Change), today announced the launch of direct issuing services for card programs in Australia and New Zealand. This offering will enable bank and fintech clients in Australia and New Zealand to deliver digital and physical prepaid and debit cards to their customers.

Change CEO Alastair Wilkie said, “Change’s direct card issuing capability allows clients in Australia and New Zealand to offer virtual and physical cards, controlling expenses, reducing operational burden, and creating new lines of revenue.

We can help small to medium sized banks and fintechs compete in a highly competitive market without the operational expense. In fact, we are changing the dynamic by giving them the payment solutions needed to level the playing field against the bigger banks and competitors,” added Mr Wilke.

As the demand for online payments in Australia and New Zealand continues to rise, small to medium sized banks and fintechs are under pressure to innovate and keep loyal customers engaged. The ability to tap into direct issuance is a key strategy for many smaller operators as they go on the offensive.

Traditionally these financial institutions have had few options for card issuing and could not compete with the functionality and technical richness offered by major issuers.

“We have seen in the Oceania region, and specifically in New Zealand, agency services from the major banks restricting the use of digital payment options like Apple Pay to the likes of credit unions and mutual banks. Change can replace these traditional agency service providers to deliver modern solutions that retain and attract customers to smaller banks and fintechs,” Mr Wilke explained.

Change uses innovative and scalable technology to provide tailored payment solutions, card issuing and testing to banks and fintechs. The company manages and processes more than 16 million virtual, credit, debit and prepaid cards worldwide. Change’s payments technology and management services are used by over 147 clients in 41 countries. Clients include BDO Unibank, ME Bank and eftpos Australia.

Change’s Vertexon PaaS platform seamlessly integrates with a businesses’ core systems enabling them to easily deliver physical and digital card solutions to their customers as well as offering other features such as Buy Now Pay Later (BNPL), transaction processing for all major schemes, including Mastercard, Visa, Amex, JCB and UnionPay and integrated loyalty programmes.

“Our clients outsource the operational work involved in direct card issuing to us so they can receive the scale benefits without the operational burden. Cards, whether digital or physical are a scale business. You need some way to offer and manage that and we can help,” Mr Wilkie said.

With its recently acquired Financial Services Provider (FSP) approval in New Zealand and with its Australian Financial Services License (AFSL) application underway, Change also takes on the burden of Payment Card Industry Data Security Standard (PCI-DSS) certification with the schemes, technology platform and processing, lowering the barrier for entry for clients in Australia and New Zealand.

By outsourcing issuance, banks and fintechs can focus on their core business and leverage the loyalty they’re known for, generating more customer satisfaction while creating new revenue and data streams. And, they don’t have to worry about losing customers to other financial institutions trying to cross-sell competing banking services.

Change’s direct issuing can deliver card solutions for fintechs looking to add card payments to enhance their financial product offerings. Small to medium banks and non-bank deposit takers (NBDTs) now have a partner to deliver modern digital cards to their customers without having to partner with larger competitors.

Award winning cloud banking platform Mambu and global payments as a service (PaaS) provider Change Financial (Change), today announced a partnership to deliver market leading digital banking and payment capabilities in Australia and New Zealand.

The partnership will see Change’s Vertexon PaaS platform, which enables banks and fintechs to deliver physical and digital card payments and processing, added to Mambu’s application programming interface (API)-driven cloud banking platform. With today’s customers expecting on-demand access to multiple digital payments and modern banking experiences, Mambu and Change will leverage an ecosystem approach, working together to deliver fast-to-market SaaS solutions to Australian and New Zealand financial institutions. The partnership will allow seamless integration of adding prepaid, debit and credit card and processing capabilities as well as digital card payments like Apple Pay, Google Pay and Samsung Pay to Mambu’s platform. Change’s solutions include Buy Now Pay Later features for cards and transaction processing for all major schemes, including Mastercard, Visa, Amex, JCB and UnionPay.

Mambu Managing Director Asia Pacific, Myles Bertrand said, “Mambu’s partnership with Change strengthens our digital payments capabilities, whilst enabling Change to connect its customers to our market leading cloud-native core banking solution.

Change’s product roadmap and focus on the provision of seamless digital payments is a powerful addition to Mambu’s composable cloud banking foundation. We see a great deal of synergy in this partnership, and we’re excited about the opportunities it will bring to our customers.”

Change Chief Product Officer, Vinnie D’Alessandro, said, “The strategic partnership with Mambu supports our growth objectives for the Australian and New Zealand markets. Our card payments and processing technologies are essential for a modern digital banking experience, and our combined solutions with Mambu’s composable banking platform will deliver innovative payment and digital banking solutions to our end customers.”

Mambu General Manager Australia and New Zealand, Paul Apolony, added “Change is a leading provider in the global payments space, like Mambu they’re committed to digital transformation using SaaS solutions and a customer-centric approach. We believe our combined functionalities will enable customers of both organisations to shift to a high-velocity operating model with minimal effort.”

Mambu will also be working with Change to make their payment emulation and testing solution, PaySim, available to clients. PaySim allows financial institutions to simulate and test the full payment lifecycle of their systems including load and stress testing as well as ATM, POS and card scheme simulation.

“We look forward to leveraging the synergies this partnership brings to deliver agile and fast to market results for our customers,” Mr Apolony concluded.

Mambu is the cloud banking platform where modern financial experiences are built. Launched in 2011 Mambu fast-tracks the design and build of nearly any type of financial offering for banks of all sizes, lenders, fintechs, retailers, telcos and more. Our unique composable approach means that independent components, systems, and connectors can be assembled in any configuration to meet business needs and end user demands. Mambu has 800 employees that support 200 customers in over 65 countries – including N26, BancoEstado, OakNorth, Raiffeisen Bank, ABN AMRO, Bank Islam and Orange Bank.

Learn more about Mambu at www.mambu.com

Change Financial (Change) is an experienced global fintech, listed on the Australian Securities Exchange (ASX) providing tailored payment solutions, card issuing and testing to banks and fintechs. Partnering with over 147 clients across 41 countries Change delivers simple, flexible, and fast-to-market payment solutions.

Managing and processing over 16 million credit, debit, and prepaid cards worldwide, Change also provides the default standard for payments testing for many Australian companies, including Australia’s domestic card payment service eftpos.

Learn more about Change at www.changefinancial.com

Change Financial was features in Fintech Australia’s Five Fintech on Friday along with Kanopi, FirstAML, MyLenda, and Radium Capital

Change Financial (ASX:CCA) partners with fintechs and banks, to provide tailored payment, card issuing, and testing solutions. The global fintech has over 146 clients across 41 countries, managing and processing over 16 million credit, debit, and prepaid cards, delivering flexible and fast-to-market payment solutions. Change’s Vertexon provides leading digital and physical card solutions for banks and fintechs. Vertexon makes it simple for clients to launch full featured digital payment experiences to their end consumers fast.

Five of the top ten global payment companies trust Change’s PaySim for payment simulation and testing solution, helping them meet the reliability and performance expectations.

https://www.fintechaustralia.org.au/five-fintechs-on-friday-february-4-2022/

After onboarding multiple new clients to its global platform, Change Financial (ASX: CCA) is set to convert its recent product launches into new sales opportunities via Stockhead

Fintech payments leader Change Financial confirmed achievement of key platform milestones and new sales in an exciting quarter update this morning.

Among a number of operational highlights, CEO Alastair Wilkie flagged the successful launch of the company’s Vertexon platform, with additional products under development and a strong pipeline of new work opportunities – both in Australia and globally heading into 2022.

“We continued to grow our sales pipeline and see these opportunities progress through the sales funnel. During the quarter, we converted a significant number of opportunities into contracted revenue which will be realised in future quarters,” Wilkie said.

Importantly, Change commenced onboarding its first payments-as-a-service (PaaS) client in the lucrative US market during the quarter and is now pursuing multiple new clients leads across the US, Australasia and Latin America.

Accompanying that strong momentum, Wilkie and the CCA executive team have a clear strategic vision and key performance metrics to drive further growth in the year ahead.

Business highlights

Across the company’s operational objectives, CCA achieved a priority target in Q4 with the successful launch of Vertexon – a modern digital solution for banking clients to unify back-end process for prepaid, debit and credit cards.

During the December quarter, Change launched the Vertexon SaaS platform on Amazon Web Services (AWS) in Sydney, to service banks and fintechs in the Oceania region.

Delivered on schedule and on budget, the platform is highly scalable with the functionality for rapid global rollouts in response to client demand.

Along with that in-market launch, CCA also completed the beta phase of testing on the new Application Programming Interface (API) for PaySim – its SaaS-based automated payment testing solution that allows banks and fintechs to accelerate their development and product release cycles, the company said.

“The API enables clients to automate load, stress and regression testing to produce comprehensive results reporting and is the foundational component of PaySim’s software as a service offering,” CCA said.

As a measure of its product market-fit, PaySim is already in use by five of the top 10 digital payments companies globally, and marks a particularly exciting growth channel for Change.

Client momentum

In line with those key successes in product development, CCA was also able to convert its momentum into a number of new client wins.

Among them was the addition of a new fintech Mastercard prepaid card program in the US, which will deliver a minimum contract value of US$700,000 (~$1.0m) over an initial three-year term.

Client on-boarding is “well-progressed” and is expected to go live in the March quarter 2022, CCA said.

In addition, the company has secured US$1.3m (~$1.8m) of sales across its new product platform, with “US$1.1 million of Vertexon projects and US$200,000 of PaySim projects for existing clients”.

“Change expects further significant client wins to close in the third and fourth quarters of FY22 as opportunities progress through the sales funnel,” the company said.

The net outcome is that investors can look forward to a steady pipeline of growth for new revenue and cash-flow channels, as CCA continues to build its client base.

Importantly, around 55% of CCA’s revenue has been generated from recurring revenue streams.

Contracted ARR increased to US$4.7m, led by the successful onboarding of Change’s new PaaS client in the US market.

And as evidence of its strong momentum, Change highlighted that its sales pipeline grew by a net-24 opportunities in the December quarter to 158, while 23 new client opportunities were won and closed out.

“There was a significant increase in customer invoicing in Q2, particularly in December, which is expected to drive cash collections in Q3,” Change said.

With a scalable platform that services more than 16 million payment cards and 147 clients in 41 countries, CCA continues to carve out a profitable niche in the multi-billion dollar global payments market.

And following a transformative period in the second half of 2021, the company is set for a big year of growth in 2022.

https://stockhead.com.au/tech/change-financial-continues-to-drive-growth/

Change Financial (ASX:CCA) CEO Alastair Wilkie joined as host of ASX company leaders to share their highlights for 2021 via Stockhead.

It’s been another year of lockdown and supply challenges for all companies dealing with the COVID-19 variants as they pop up. But with challenges, comes opportunities to learn and grow. So as the end of the year approaches, we took the chance to tap our client list and ask CEOs of ASX-listed small caps – from sand miners to cannabis growers to fintechs – what they learnt in 2021, their highlights, and what they hope for in 2022.

Today, we ask: What was your company highlight for 2021?

Alastair explained “We had three really important events”

- Completing our core card management and processing platform in the US and launching it that into market;

- Following that, we made a strategic and transformative acquisition that expanded our US operations into a global payments solutions business. This, in turn, sped up our three-year strategic roadmap by 18 months; and

- We launched our customer ready integrated payments as a service solution “Vertexon.” This was an exceptional performance by the team to achieve that within a year

To hear the experiences from Alastair and the rest of the leader, check out the full article https://stockhead.com.au/news/ceos-look-back-and-share-their-company-highlights-from-2021-2/

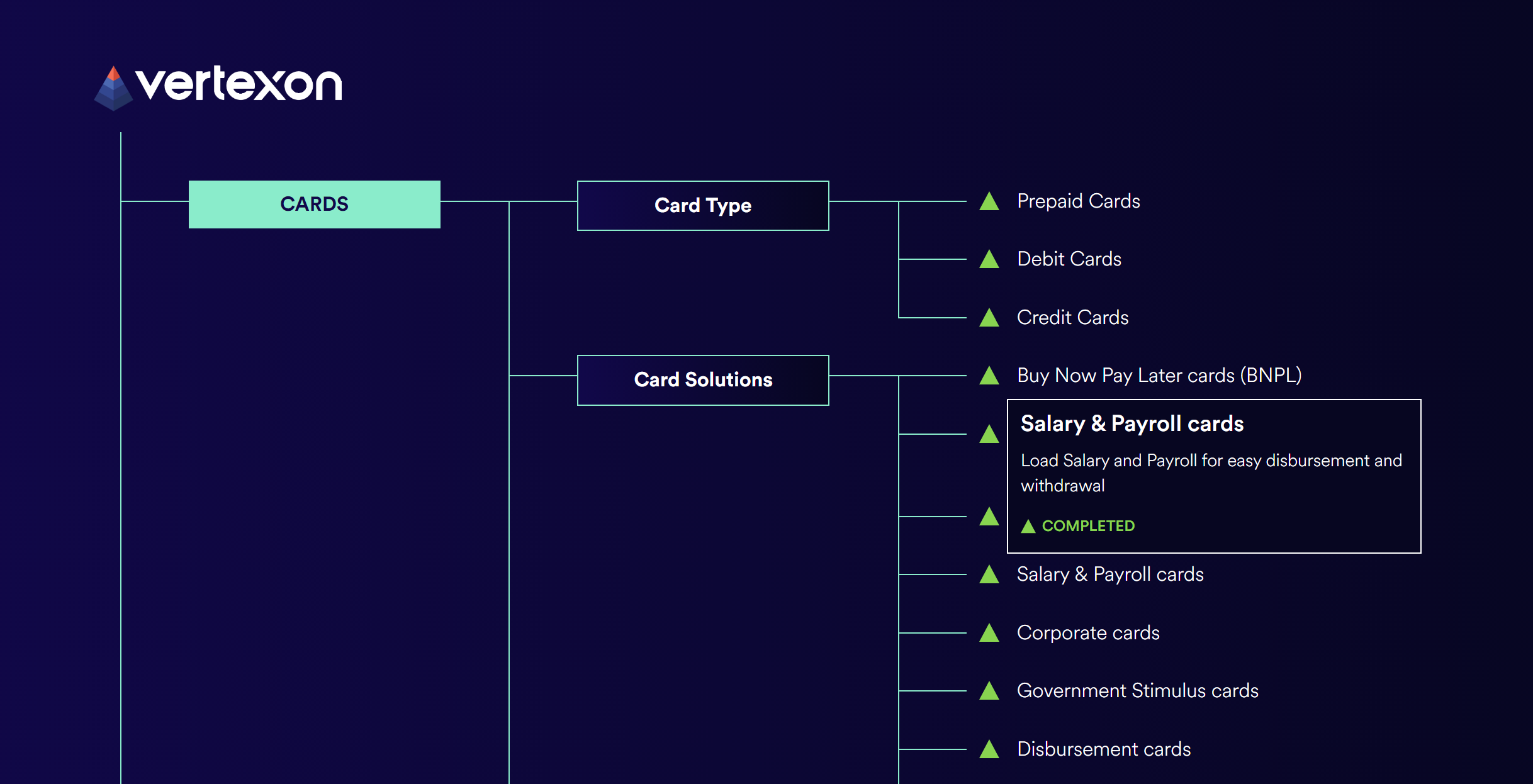

Showcasing the features and future development of our Payments as a Service Platform, Change is proud to launch the Vertexon Roadmap.

Senior Vice President of Payment Solutions, Nick Beach, celebrated the release of the roadmap to Change’s website. “Our Product and Technology teams have been investing a huge amount of effort into our product roadmap for Vertexon. Now we can clearly show our broad feature set as well as our current future development plans. I’m excited to share the Vertexon Roadmap on our new website for our Payments as a Service offerings for Oceania, Southeast Asia, LATAM and North America. “

Chief Product Officer, Vinnie D’Alessandro, explains the importance of Change publishing its product roadmaps. “With the release of the Vertexon Roadmap, we now have complete transparency around the Change product strategy. Vertexon offers a wide range of card issuing and transaction processing capability and it can be difficult to articulate just how many features we can offer our clients. The Vertexon Roadmap gives us an elegant method of representing the power of our Payments as a Service platform and our upcoming features.

The roadmaps will be regularly updated as features are released, and new items are added to the development pipeline.

The Vertexon Roadmap is available on the Change website, along side our PaySim Roadmap for the payment testing solutions.

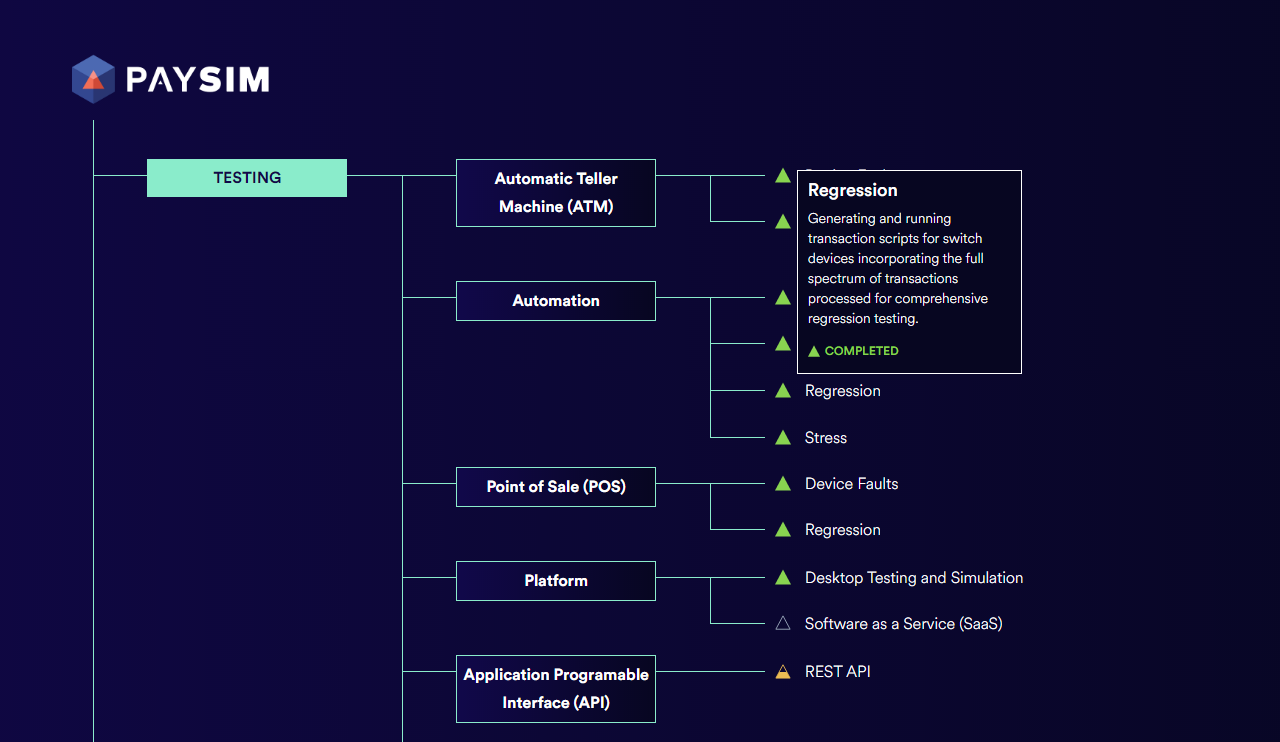

Showcasing the features and future development of our payment testing and simulation solution, Change is proud to launch the PaySim Roadmap.

Our Senior Vice President of Testing Solutions, Ewan Wilson, celebrated the release of the roadmap to Change’s new website. “I’m proud to be able to publish our roadmap for PaySim to our clients and payments industry. Our Product and Technology teams have been focused on delivering new capabilities for our testing solution and it is exciting for us to share our journey with the world.”

Chief Product Office, Vinnie D’Alessandro, explains the importance of Change publishing its product roadmaps. “At Change, we believe in having open and transparent communications. We engage with our clients and partners to help plan and prioritise our new feature development. Sharing our progress and achievements plays a significant driver to deliver transparency to the market.

“Shortly we will be releasing our Vertexon Roadmap to share our Payments as a Service development activities.”

The roadmaps will be regularly updated as features are released and new items are added to the development pipeline.

The PaySim Roadmap is available on the Change website.

The deal with a US-based fintech company today was a major milestone for Change Financial, as it embarks on an expansion strategy in the US.

Just two weeks after signing a partnership deal with Axiom Bank, Change Financial (Change)(ASX:CCA) is already about to onboard a new client to its payments platform.

Change has just won a contract with a US-based fintech, which is set to become the first card program to be launched under Change’s partnership with Axiom Bank.

The client will transition to Change’s platform and leverage its Program Management service offering – a technology that enables clients to focus on value-added activities within their areas of expertise.

Along with processing, card and program management, Change’s payments platform also provides mobile apps, giving customers digital control of their cards.

The contract signed today will generate a minimum of US$0.7 million (A$1 million) in revenue for Change over an initial three-year term following launch, which is anticipated in Q3 FY22.

Revenue from the program will primarily be generated through interchange, transaction fees, cardholder fees, and program management services – with minimum fee commitments adding to Change’s annual recurring revenue.

Although still unknown at this stage, the company expects to earn more than the minimum US$0.7 million over the term of the contract.

Change CEO, Alastair Wilkie, said the signing was an important milestone as it executes on the strategy to grow in the US.

“We are thrilled to be adding a new client on the Change platform in the US, where we are starting to see increased traction with our product and service offerings,” Wilkie said.

“Supporting a benefits card program is confirmation of the versatility of our platform and also leverages our long-standing expertise in card program management and compliance.”

Expansion into the US

The three-year partnership signed with Axiom Bank in late September was a key step towards expanding Change’s reach in the US.

And as today’s deal showed, it’s a key relationship when onboarding fintechs in the country.

Change aims to onboard potential fintech clients with Axiom as the issuing bank, leveraging its Mastercard registered processor and payments platform, Vertexon.

Wilkie has said the US is a key focus of his FY22 strategy, as the company executes on its growth strategy.

Change’s top line revenue surged from US$300,000 in FY20 to US$8.4 million ($11.3 million) in FY21 – a year described by management as being “transformational”.

The company expects its sales pipeline to grow even further in FY22, as it focuses on global business development strategies.

CCA’s payments technology provides the critical infrastructure that connects existing licensed banks with modern API-driven brands, such as fintechs.

The platform currently manages and processes more than 16 million virtual, credit, debit and prepaid cards worldwide, serving 136 clients in 36 countries.