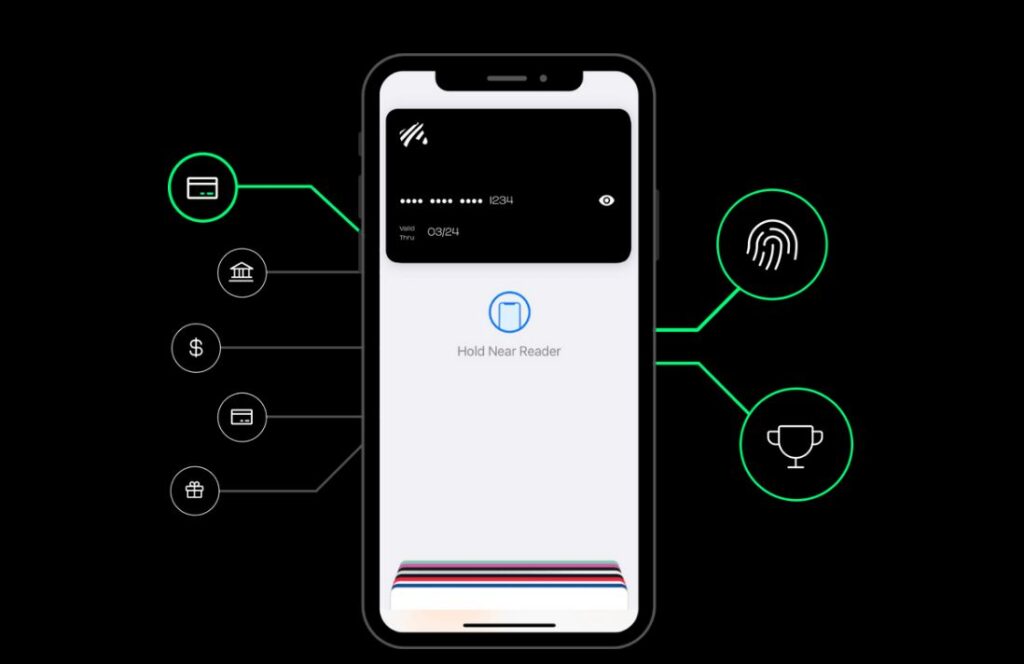

- OtherPay is pioneering safer shopping and stronger authentication with unique payment card and mobile integrated solutions.

- Change Financial and Fintech Actuator partnered with Mastercard in August 2024 to launch an incubator program to support innovation – turning bold ideas into reality.

Brisbane-based fintech, Change Financial, has today announced OtherPay as the latest participant in its Prepaid Incubator program. OtherPay is a fast-growing fintech platform revolutionising electronic payments and consumer authentication.

Focused on ending purchase and identity fraud, OtherPay aims to bridge the gap between traditional banking and the evolving needs of modern consumers. By participating in the incubator, OtherPay will introduce prepaid card functionality into its platform, enhancing its offering with new tools and features for purchase and identity protection.

Simon Hewitt, Chief Executive & Innovations Officer at OtherPay said “We’re proud to be part of the program and to work alongside Change Financial and Fintech Actuator. This collaboration provides us with a valuable opportunity to accelerate the development and launch of our unique payment card features where we believe that innovation meets common sense and where both purchase and identity fraud can be prevented.”

Tim Boucaut, CEO, of Fintech Actuator commented: “OtherPay is building a solution with the potential to put an end to purchase and identity fraud. We’re excited to support their journey and bring their innovation to market through this program.”

In this alliance, Change Financial will issue Mastercard prepaid cards, with Fintech Actuator managing the program, aiding FinTechs with comprehensive guidance from onboarding to design and execution.

The incubator program, which launched last year, saw Change Financial and Mastercard create an environment that empowers emerging FinTechs to innovate by running small scale prepaid card solutions to test their products in market, without the cost and extensive processes involved in launching their own custom card programs.

Each program runs for a period of six to nine months, providing continuous support and guidance to the participating FinTechs.

“This innovative incubator program was crafted with a vision to accelerate the growth and innovation of Australian FinTechs, ensuring they have the necessary tools and support to navigate through the initial stages of development and market testing. This latest partnership with OtherPay is this vision in action,” said Tony Sheehan, Chief Executive Officer of Change Financial.

- Accountedfor.com.au delivers a complete business accountant service – in the palm of your hand.

- Change Financial and Fintech Actuator partnered with Mastercard in August 2024 to launch an incubator program to support innovation – turning bold ideas into reality.

Brisbane-based global fintech, Change Financial, has today announced the next participant in their Prepaid Incubator program – Accountedfor, a platform redefining how professional services firms engage with clients and deliver integrated financial solutions.

Accountedfor is a modern financial services platform that empowers accounting and advisory firms to deliver streamlined, real-time financial services to their clients. With an emphasis on automation, transparency, and user experience, Accountedfor is pioneering the next generation of account practice management – including integrated spend control via prepaid card solutions.

David Thornton, Co-Founder of Accountedfor said “We’re excited to be part of the Incubator program and work closely with Change Financial and Fintech Actuator. This partnership provides us with an opportunity to integrate prepaid card capabilities into our platform and deliver greater value and innovation to our clients.”

Tim Boucaut, CEO, Fintech Actuator commented: “Accountedfor brings a fresh perspective to the professional services space, and their vision aligns perfectly with our goal of supporting emerging FinTech’s. We’re thrilled to partner with them to help bring their solution to market.”

In this alliance, Change Financial will issue Mastercard prepaid cards, with Fintech Actuator managing the program, aiding FinTechs with comprehensive guidance from onboarding to design and execution.

The incubator program, which launched last year, saw Change Financial and Mastercard create an environment that empowers emerging FinTechs to innovate by running small scale prepaid card solutions to test their products in market, without the cost and extensive processes involved in launching their own custom card programs.

Each program runs for a period of six to nine months, providing continuous support and guidance to the participating FinTechs.

“This innovative incubator program was crafted with a vision to accelerate the growth and innovation of Australian FinTechs, ensuring they have the necessary tools and support to navigate through the initial stages of development and market testing. This latest partnership with Accountedfor is this vision in action” said Tony Sheehan, Chief Executive Officer of Change Financial.

- Change has signed a new flagship PaaS client in New Zealand – Unity Credit Union

- Over 20,000 Unity Credit Union debit cards will be issued on Change’s Vertexon Platform

- Change has now signed six New Zealand financial institutions, including the two largest credit unions in New Zealand, representing over 65,000 account holders

Change Financial Limited (Change), a leading ASX listed (CCA) Australian payments fintech, has signed a new Payments as a Service (PaaS) contract with Unity Credit Union (Unity), one of the largest credit unions in New Zealand, to provide direct issuing, processing and card management solutions via its Vertexon platform.

Change has commenced the onboarding process, with Unity expecting to have approximately 20,000 debit cards, in circulation by December.

Change Financial CEO, Tony Sheehan said, “It’s great to see a large and well-respected credit union like Unity choose Change Financial in New Zealand for fast, reliable, and seamless consumer card solutions. We have made significant investment in our platform and like our other financial institution clients in New Zealand, Unity is making the switch to Change to take advantage of advanced features and services that allow them to deliver superior payments experiences to their customers.

“We now have a significant presence in the New Zealand market with our platform servicing the two largest credit unions.”

“With our Vertexon platform fully operational, it is highly encouraging to secure another significant client as we build scale and momentum.” Mr Sheehan said.

Unity will use Change partner Finzsoft Solutions Limited (Finzsoft) as their core banking platform provider, so given these synergies the development work for the onboarding process has already substantially been completed, creating immediate efficiencies for all parties. The addition of another credit union to Change’s suite of customers throughout the New Zealand market is further recognition of the strong partnership and combined value offering of Change and Finzsoft.

Unity Credit Union CFO and acting CEO, Bruce Morrin said, “Change’s product and service offering will enable us to improve the payments experience for our customers. From being able to offer enhanced features such as Apple Pay and Google Pay, to having superior controls that reduce fraud and other operational costs, we can provide modern card features that rival the major banks, a significant and unique value proposition for non-bank financial institutions like us.”

Change has now secured the two largest credit unions in NZ as Vertexon PaaS clients in addition to several other NZ financial institutions and fintechs. Once the migration with Unity is complete, it will take the total number of account holders serviced via the Vertexon platform within New Zealand to over 65,000.

Mr Sheehan added, “Change Financial is continuing to expand its presence within the New Zealand market, which comes at a time when it is still quite difficult for smaller to medium sized New Zealand businesses to access consumer card programs, beyond those offered by major banks. By addressing this gap in the market, we will continue to build our presence whilst also improving the payments experience for consumers.”

- Change Financial wins new client, HealthNow and together they aim to revolutionise workplace wellness in New Zealand

- HealthNow’s Employer Aid sets a new standard for workplace wellness, empowering employers in supporting employee wellness and health improvement

- Employer Aid aims to provide New Zealanders with a seamless payment experience through a one-card approach

- Employer Aid will integrate with Change Financial’s Vertexon payments platform, leveraging Change’s Mastercard issuing capability in New Zealand, ensuring a robust and reliable payment infrastructure for HealthNow’s clients

Auckland, 24 August 2023: Change Financial Limited (Change), a leading ASX-listed (CCA) Australian payments fintech, is thrilled to announce New Zealand health services pioneer, HealthNow, has chosen Change’s Vertexon platform to power their Employer Aid prepaid card program. Employer Aid is set to revolutionise how New Zealand employers support and promote the health and wellness of their employees.

Employer Aid, powered by Change’s Vertexon platform and leveraging its Mastercard issuing capability in New Zealand, is HealthNow’s solution to the growing need for proactive health solutions in the workplace. 1 According to the 2023 Global Survey by Virgin Pulse and YouGov,

76% of workers believe their company should be doing more to support the mental health of their workforce.

The program works closely with employers to educate staff on how to use their health allowances effectively, ensuring they remain healthy and well. The one-card approach eliminates barriers, offering a smooth payment experience and acting as a constant reminder for employees to prioritise their healthcare.

Tony Sheehan, Change Financial Chief Executive Officer, said, “It’s exciting to have HealthNow as a new client and to enable them to achieve their vision of launching Employer Aid. This collaboration is a testament to our shared commitment to providing innovative financial

solutions tailored to the needs of New Zealanders.”

Steven Zinsli Founder & CEO of HealthNow highlighted the program’s innate ability to adapt to the different needs of each employee.

“Employer Aid allows employers to acknowledge the diverse health needs of their employees, recognising for example that the ideal employee benefit for a 25-year-old differs from that of a 50-year-old. “Our program provides an effective alternative to traditional health insurance, shifting the focus to

preventative healthcare. By allowing employers to select their contribution value, we ensure that Employer Aid fits seamlessly into any budget,” Mr Zinsli commented.

With Employer Aid, HealthNow is offering both a payment solution and championing a shift in how employers view and support employee health. By focusing on preventative rather than reactive healthcare, HealthNow is setting a new standard for workplace wellness in New Zealand.

New Zealanders can anticipate the launch of the Employer Aid prepaid card program towards the end of 2023, marking a significant step forward in health-focused financial solutions.

HealthNow and Change Financial are exploring expanding their partnership into the Australian and US markets in the coming months.

1 2023 Global Survey of workplace wellbeing priorities, by Virgin Pulse and YouGov, May 2023

- Simply Zibra is launching AI-powered virtual cards through Change Financial to empower consumers to spend in a smarter way.

- Simply Zibra seeks to drive better financial outcomes for consumers by using AI to source loyalty program benefits, low fees, cashback incentives and rewards points on everyday payments – automatically.

- Change Financial will provide Mastercard card issuing to provide the payments capability in market

Brisbane, 15 August 2023: Change Financial Limited (Change), a leading ASX-listed (CCA) Australian payments fintech, today announced it will provide Mastercard card issuing to Simply Zibra, an AI-driven digital wallet that helps consumers get the most out of their money. Using AI, the system optimises every payment made via the Change issued Mastercard through analysing the transaction in real time and selecting the card that will provide the most benefits for the consumer. These benefits can include lower foreign exchange fees and interest, frequent flyer miles, cashback opportunities and rewards points, depending on the preferences and goals of the user.

Change Financial Chief Executive Officer, Tony Sheehan, said the partnership aims to offer unprecedented benefits for consumers, by allowing them to automatically receive third party savings that they may not otherwise be aware of. “We are proud to be powering Simply Zibra’s innovative technology with our card issuing capabilities. Their commitment to supporting financial optimisation through AI-driven personalisation is a breakthrough for Australian consumers.” said Mr Sheehan. “Our card issuing capabilities have helped bring this innovation to market and it will facilitate the use of this technology for online and in-person payments, with consumers able to reap the rewards in a matter of seconds.”

The platform links all of a consumer’s accounts including debit cards, credit cards and saving accounts, to ensure that the AI process can work efficiently, by drawing on spending habits and information from a broader range of sources. Simply Zibra upholds data security by partnering with licensed entities to safely store financial data. The company does not hold a customer’s funds and has ‘read-only’ access to information.

Simply Zibra Chief Executive Officer, Trina Ray Choudhury, said by connecting a user’s existing suite of cards and accounts to automate payments, they can deliver greater financial outcomes for consumers through harnessing the benefits of AI. “We are delighted to join forces with Change Financial. Together we’re able to bring a pioneering payments tool to market that redefines how consumers manage and use their finances. This venture brings us one step closer to our goal of enhancing the financial lives of Australians.” Mrs Ray Choudhury said.

“Consumers are often missing hundreds of dollars in potential savings and by using AI, our technology works in the background, automatically applying relevant savings or even earning hidden rewards, without the consumer having to spend hours sorting through information.

This product and service will be available to the market towards the end of 2023.

- Change Financial (Change) and Fintech Actuator are partnering with Mastercard to launch an incubator program for Australian fintechs to trial prepaid card solutions.

- Under the partnership, Change will issue Mastercard prepaid cards and Fintech Actuator will act as the program manager to assist fintechs with onboarding, scope and design.

August, 1st 2023: Brisbane-based global fintech and payments as a service (PaaS) provider, Change Financial, has partnered with Mastercard and Fintech Actuator to make card programs more affordable and accessible to local fintechs and startups.

Under the program, Australian companies will be able to run small scale prepaid card solutions to test their products in market, without the cost and extensive processes involved in launching their own custom card programs.

Chief Executive Officer of Change Financial, Tony Sheehan, said the partnership was one of the first of its kind in Australia and will nurture startups by providing greater access to enabling card programs, previously unattainable.

“Australia continues to be a popular global fintech hub and we see many of these new businesses unable to complement their product offering with a card program because they don’t have the capital, expertise or understanding of the process,” Mr Sheehan said.

“This partnership with Mastercard and Fintech Actuator will significantly reduce these barriers to entry for startups creating greater opportunities for local fintechs.”

The advantage of the program is that it will offer low-cost onboarding and holistic support and guidance services throughout the establishment, testing and rollout stages.

Dan Martin, vice president and head of digital partnerships, Australia at Mastercard, said that as the fintech market in Australia continues to evolve and expand, collaboration between likeminded organisations can drive real impact in helping new entrants scale quickly.

“Speed to market, testing and increased agility are paramount in driving innovation and propelling smaller fintechs forward. Mastercard’s aim is to foster an ecosystem that allows fintech startups to thrive, contributing to the overall advancement of the Australian fintech industry. Mastercard supports fintechs with the industry experience, technology and connections that it has built across many decades,” said Martin.

Each program will run for between six and nine months and at Mastercard and Change Financials’ discretion, fintechs will have the opportunity to roll out a prepaid card program that is serviced through Change Financial and Mastercard.

Fintech Actuator’s Tim Boucaut commented “Startups and many smaller companies don’t meet the scale and volume requirements to launch a card program, and this partnership changes that. By guiding businesses through the process and providing support to test and validate an idea, we are enabling more local innovations to successfully launch in the ever-growing payments space.”

The program will commence in September 2023.

You can find more information at https://www.fintechactuator.com/

• Change Financial is the first non-bank business to offer New Zealand (NZ) fintechs, non-bank lenders and mutuals exclusive access to a payment Application Programming Interface (API) sandbox, previously only available through major banks.

• This free access to payment API sandbox technology ultimately enables fintech users to deliver card offerings faster to market by removing the bureaucracy and complex processes of major banks.

• Change is a card issuer in New Zealand, Australia and the United States and provides transaction processing and card management solutions in Latin America and South East Asia.

Australian based global fintech and Payments as a Service (PaaS) provider, Change Financial (Change), is the first non-bank payments specialist to launch a new payment API sandbox in New Zealand (NZ), providing fintechs, non-bank lenders and mutuals with exclusive access to this technology.

This new payment API sandbox will allow fintechs to test their digital card product and service through Changes’ Vertexon technology to improve effectiveness and efficiency whilst finessing any issues.

Demand for digital and physical card payments capabilities in New Zealand is set to rise as the e-commerce market is projected to grow by 38 percent between now and 2025, reaching US$8.8 billion, according to the March 2022 Global Payments Report.

Change CEO and Managing Director, Alastair Wilkie, explained whilst Changes’ payment API sandbox is available globally, it is particularly important for the New Zealand payments market as it is the first of its kind, allowing New Zealand fintechs access to this technology without the costs and processes attached to major banks.

Finzsoft Chief Executive, Helen Hatchard said, “Change’s new payment API sandbox will help accelerate the development of our digital services and aid growth for our New Zealand clients through innovation, supported by thorough and sophisticated development and testing.

This announcement is great news for businesses across New Zealand that are looking for physical and digital card solutions as it will provide non-bank lenders and mutuals with access to technology previously only available through the major banks,” Ms Hatchard remarked.

The 2021 Environmental Scan Report from Payments NZ notes that the need for faster, more innovative payments continues to increase, making it possible for people and businesses to better integrate their digital and physical worlds.

“Change acknowledges that the New Zealand payments space is lagging the rest of the world, and innovations like these provide fintechs with greater access to fast, reliable and well-integrated solutions that can ultimately benefit consumers,” Mr Wilkie concluded.

The API sandbox can be accessed from our Developer Resources page.

- Change is powering card capabilities in the underserviced New Zealand market, providing mutuals greater access to digital and card payment solutions.

- More than 35,000 debit cards across four programs will be issued on the Mastercard network and processed through Change’s Vertexon platform.

- The announcement comes as New Zealand’s e-commerce market is projected to grow by 38% before 2025.

Australian based global fintech and Payments as a Service (PaaS) provider, Change Financial (Change), announced it has partnered with fellow fintech solutions provider Finzsoft to sign agreements with four New Zealand mutuals to offer direct issuing, processing, and card management solutions via its Vertexon platform. This partnership makes card payment solutions more accessible to the underserviced New Zealand payments space.

The instant issuance of digital cards and integrated cardholder API software are not widely accessible in the New Zealand market and First Credit Union, Nelson Building Society, Westforce Credit Union and Police Credit Union will leverage these technologies using Change’s Vertexon platform to improve efficiency and the overall user experience.

This follows Change’s recent partnership announcement with Mastercard, enabling them to deliver direct issuing capabilities for their Australian and New Zealand clients. More than 35,000 debit cards will be issued on the Mastercard network and processed through Change’s Vertexon platform.

Demand for digital and physical card payments capabilities in New Zealand is set to rise as their e-commerce market is projected to grow 38 percent between now and 2025, reaching $8.8 billion (USD), according to the March 2022 Global Payments Report. In addition to this, the report reveals buy now, pay later (BNPL) is the fastest growing online payment method and set to account for 17 percent of e-commerce transaction value by 2025.

Change CEO and Managing Director, Alastair Wilkie said, businesses and consumers across New Zealand currently have limited access to contemporary card technologies and this partnership will expand available opportunities to advance the market overall.

“Change is among the first to offer digital wallets and modern payment solutions in New Zealand. Our landmark partnership with Finzsoft will address a clear shortcoming in the market by expanding the availability of card solutions outside of the major bank providers,” Mr Wilkie said.

Credit unions and traditional finance lenders are turning to alternative card providers, outside of the major banks for fast, reliable, and well-integrated exchanges. “By expanding this section of the market, businesses and consumers will have greater access to modern products and services,” Mr Wilkie remarked.

The instant issuance of digital cards will be available for consumers at launch and Change is already investigating opportunities to add Apple Pay, Google Pay and buy now pay later (BNPL) capabilities.

“BNPL is projected to be the fastest growing e-commerce payment platform before 2025 and by increasing consumer access to digital cards and payment solutions, we are creating equity in the market while rivalling the services offered by major banks and traditional card lenders,” Mr Wilkie concluded.

Change will partner with Finzsoft, who will deliver core banking and mobile banking apps to the four mutuals.

Finzsoft Chief Executive, Helen Hatchard noted, “The partnership will allow these credit unions to offer a modern digital payment experience to their members and allow them to strongly compete with major banks and fintechs.

We are excited to be partnering with Change once again to deliver digital transactions for accounts, lending and cards.

Change’s payments experience, product roadmap and strong New Zealand presence will create a truly modern and innovative digital experience for members,” Ms Hatchard said.

First Credit Union General Manager, Simon Scott said, “By accessing Change’s Vertexon PaaS, Mastercard issuing and card holder API systems, we can provide modern card features that rival the major banks and fintechs.”

Nelson Building Society CEO, Tony Cadigan said, “Change’s digital payment features, and services will enable us to develop new payment products to retain and attract new clients.”

Westforce Credit Union General Manager, Victor Martick said, “This partnership will benefit our members by providing modern card features.”

Police Credit Union CEO, Craig Pomare said, “Digital payments are now an essential part of the global economy, so we are excited to work with Change and Finzsoft to co-develop innovative card products for our members.”

According to the third edition of Prime Time for Real Time 2022, published by ACI Worldwide, (NASDAQ: ACIW), in partnership with GlobalData, a leading data and analytics company, and the Centre for Economics and Business Research, Australia and New Zealand are looking to a new era of real-time payments with a renewed sense of urgency and need to modernise to stay competitive.

June 2022 – Change is proud to be featured in the Federal Reserve’s FedNow Service Provider Showcase, an online resource designed to connect financial institutions looking to adopt and innovate upon the FedNow Service with service providers offering instant payment solutions.

“We’re thrilled to be part of the FedNow Service Provider Showcase and look forward to helping other organizations implement instant payments,” said Brian Hodgdon Vice President of Business Development . “With our solutions, financial institutions will be able to access the speed, convenience and other benefits the FedNow Service will provide when it launches in 2023.”

Change plans to offer the following instant payment services to organizations that are adopting the FedNow Service:

- PaySim

- Vertexon

“We appreciate the commitment of Change Financial to enabling FedNow adoption and participating in the showcase,” said Nick Stanescu, Federal Reserve Bank senior vice president and FedNow business executive. “The time is now for organizations to identify and connect with partners they’ll need to build the end-to-end solutions the market is demanding.”

To learn more, visit Change Financial profile in the FedNow Service Provider Showcase on FedNowExplorer.org.

About Change Financial

Change Financial (Change) is an experienced global fintech, listed on the Australian Securities Exchange (ASX) providing tailored payment solutions, card issuing and testing to banks and fintechs. Partnering with over 150 clients across 41 countries Change delivers simple, flexible, and fast-to-market payment solutions.

Managing and processing over 16 million credit, debit, and prepaid cards worldwide, Change also provides the default standard for payments testing for many Australian companies, including Australia’s domestic card payment service eftpos.

Learn more about Change at www.changefinancial.com

About the FedNow Service

The Federal Reserve Banks are developing the FedNow Service to facilitate nationwide reach of instant payment services by financial institutions — regardless of size or geographic location — around the clock, every day of the year. Through financial institutions participating in the FedNow Service, businesses and individuals will be able to send and receive instant payments at any time of day, and recipients will have full access to funds immediately, giving them greater flexibility to manage their money and make time-sensitive payments. Access will be provided through the Federal Reserve’s FedLine® network, which serves more than 10,000 financial institutions directly or through their agents. For more information, visit FedNowExplorer.org.

“FedNow” is a service mark of the Federal Reserve Banks. A list of marks related to financial services products that are offered to financial institutions by the Federal Reserve Banks is available at FRBservices.org.

Change was selected in a cohort of 9 Australian fintechs to participate in the Fintech Australian and Austrade program to help financial services and technology providers scale in the US market.

Across May and June, the cohort will attend the in-person program in New York where they will promote their offering, meet partners, clients, investors and mentors to build their US market presence. The cohort will also attend the Lendit Fintech 2022 Conference at the end of May, which includes the Demo Day hosted by WEVE Acceleration and Austrade.

Austrade’s Steve Rank, Trade and Investment Commissioner New York, explained “Australia’s fintech sector will be showcased in New York when 9 of the best and brightest Australian Fintech startups visit in May.”

Change will be presented by Clayton Fossett (COO) and Brian Hodgdon (VP – Business Development and Customer Relations) and promote our Vertexon Payments as a Service and PaySim payments simulation and testing products.

Change will be joined by

Change is honored to have been selected along with such esteemed fintechs and looks forward to building our presence in the US.