Vertexon powering physical and digital card payments

- Change’s Vertexon power over 450,000 digital and physical card products for ME

- Features include Apple Pay, Google Pay and other contactless payment options

- Virtual cards can be delivered to ME customer wallets within minutes

- Change is working with ME on its technology and solutions roadmaps

- New transaction streaming technology being delivered to support ME’s Open Banking and Consumer Data Right (CDR) initiatives

Partnering for the payment revolution

Leveraging Change’s Vertexon payments technology, ME Bank (“ME”) has rolled out over 450,000 innovative debit and card products to its Australian customers. Using Change’s PaySim payments simulator and testing platform, ME has also ensured its products are stable and scalable before being released to market.

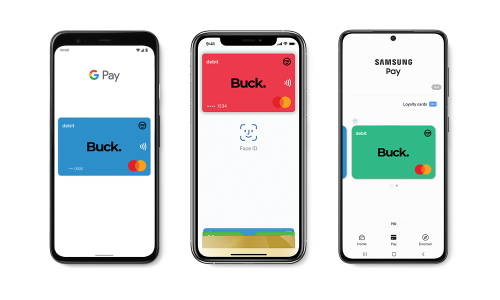

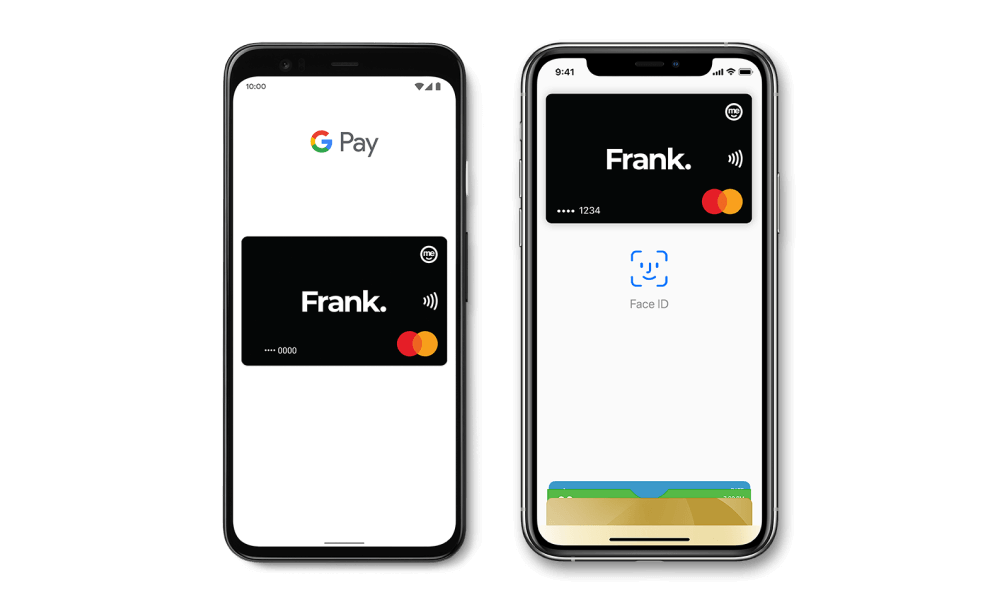

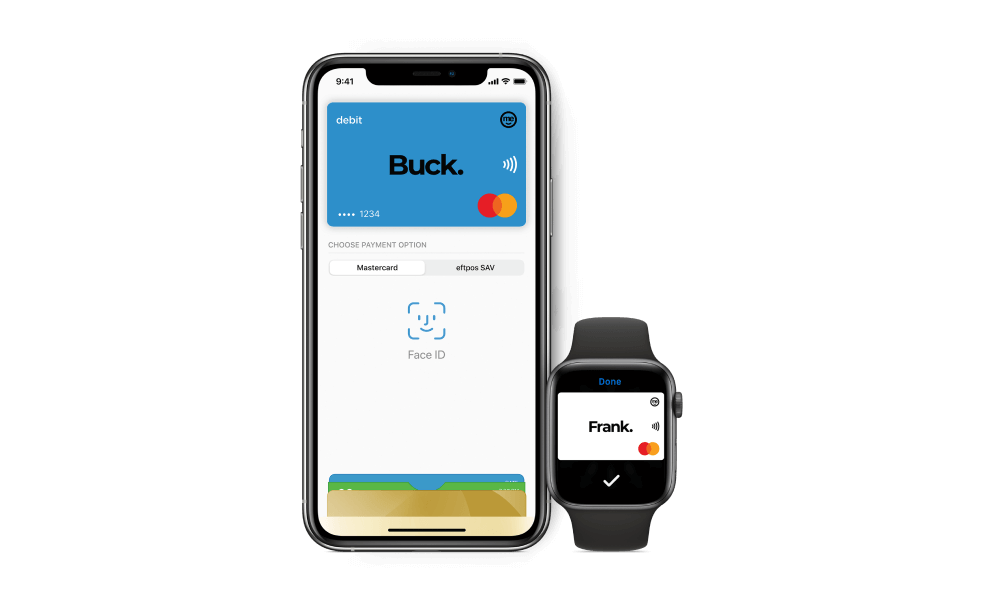

ME’s card products include the Buck card, a digital and physical Mastercard debit card and Frank, a low rate physical and digital Mastercard credit card.

ME and Change work closely together to improve the bank’s card platforms, including transaction streaming, to support Open Banking and Consumer Data Right (CDR) initiatives.

The future is open, digital and now

Sharing his thoughts on the partnership with Change, ME Bank General Manager of Core Banking, Paul Cazaz, said, the bank strives to bring innovative products to customers.

“We are very proud of our Buck and Frank cards. Partnering with Change to deliver the digital wallet capabilities has been rewarding and timely, given the global pandemic is driving cashless payments,” Cazaz said.

“We have a strong partnership with Change and we are excited by their technology and solutions roadmaps.

“Currently we are working with Change on our next range of products in order to better serve our customers in the evolving digital payments landscape,” he said.

ME’s current card features

ME’s Buck card can be delivered to a customer’s digital wallet in five minutes, allowing them to use the EFPTOS and Mastercard payment networks almost instantly, and without waiting for a physical card. As well as automatic refunds for Australian ATM fees, Buck comes in a choice of colours that are inspired by Australian banks notes.

Available in black or white, features of ME’s Frank card include the ability to add additional card holders, a 55-day interest free period as well as access to Mastercard’s Priceless rewards program.

The Buck and Frank cards are connected to Apple Pay and Google Pay, allowing customers to leverage their iPhone, iPads, iWatch, Android phones, tablets and smartwatches to make payments in store or online. Buck and Frank also support digital payments using Fitbit Pay and Garmin Pay, allowing ME cardholders to pay with a tap of their wrist, while on the run.

The digital and security features of the Buck and Frank cards include:

- EMV chip for contactless payments

- Mastercard® Identity Check™

- Apple Pay

- Google Pay

- Fitbit Pay

- Garmin Pay

- Card Lock via Mobile App and Internet Banking

Solutions Used

ATM, POS & ISO Simulation

Test ATMs, POS, interchange, regression and stress test cases concurrently, using a single system from your desktop.

Cards

Offer innovative prepaid, debit and credit card solutions to customers. Our secure and scalable platforms and services make payments easy.

Digital Payments & Wallets

Allow customers to securely pay using their mobile or smart watch with Apple Pay, Google Pay and Samsung Pay, or white label a mobile wallet.

Payment Simulation

Simulate over 60,000 variations of transaction types so there are no surprises.